The current age has seen relatively low-tension in the Arctic Region, but this may be coming to an end soon. The planet's northernmost region is no longer fully frozen and where there is liquid oceans, there will be countries, as well as other special interests looking to control those oceans.

There will be new shipping routes, new oil, gas and resource claims, and generally opportunity to control and influence this new place.

US-Canada Relationship Hinges On Old Dispute

The Northwest Passage (trade route) has long been in dispute between the US and Canada. This has been inconsequential to either party, except now the melting of the Artic ocean has created new shipping routes that could cut transit times by 40% on major routes like those connecting China and Europe. This is especially important for commodities like silver which is traditionally transported by ship, as opposed to flown due to weight and other uneconomical considerations.

Canada has long claimed the Northwest Passage as internal territorial waters, on the basis of a long history of native Inuit use of the waters, as well as legal arguments stemming from decades-old cases settled by the International Court of Justice.

The US has long countered this claim on the basis of its interpretation of the UN Convention on the Law of the Sea (UNCLOS), a treaty which it accepts as international law but has never been ratified by Congress.

Under this view, the US sees the passage as an international strait connecting two large bodies of water. However, the "international strait" designation is usually only used in cases where there is a large volume of traffic transiting the strait.

Currently, there little traffic, but this is likely to change.

Under this international strait framework, Canada has the right to regulate most aspects of traffic in the waterway, yet cannot prohibit or restrict international shipping traffic.

Inconsequential Becomes Consequential

In 2019, delegates from Arctic nations – Canada, Denmark, Finland, Iceland, Norway, Russia, Sweden and the US – had gathered in Finland to discuss balancing climate change with resource development in the region.

The council meeting ended without a joint final statement from council members, after the US delegation balked at the inclusion of the phrase “climate change", which is ironic given this talk would have never took place had the ocean not melted.

This would marked the first time the Arctic Council had failed to produce a declaration since 1996.

During the discussion, then Secretary of State, Mike Pompeo remarked that the US rejected Canada's claims to the Northwest Passage as "illegitimate".

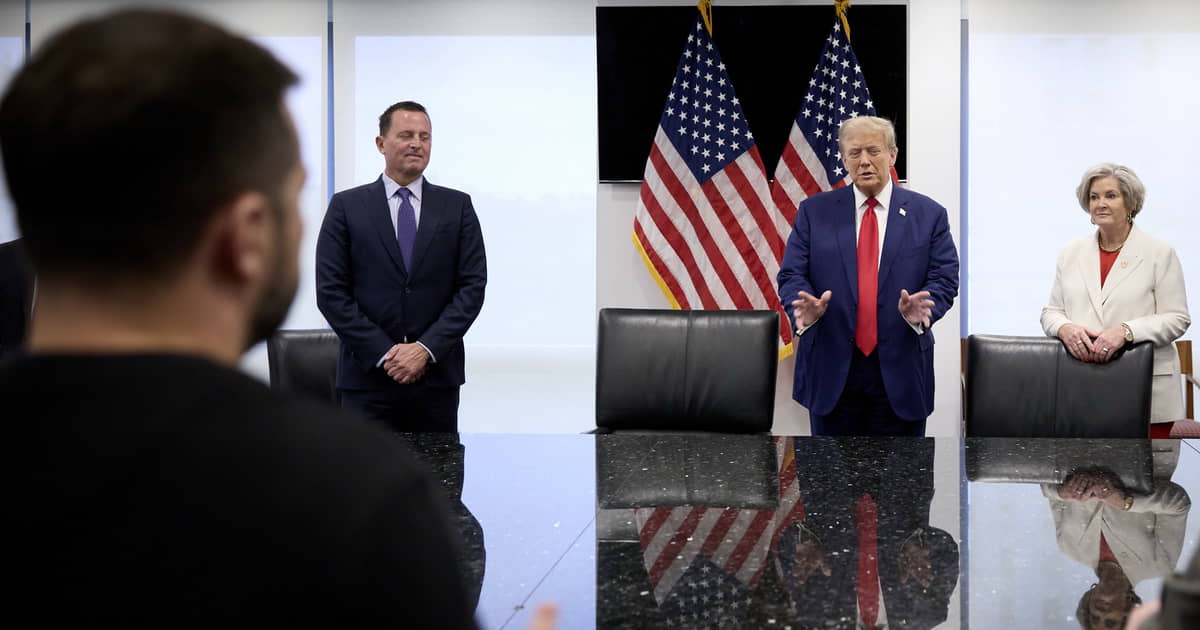

Instead of settling on just the strait, President Trump yesterday (March 11, 2025) expressed his administration's desire to see Canada become the 51st State, which would give the US a strategic advantage in competition with the BRICs over the Arctic trade routes and better military defense posturing against Russian aggression in the area.

Strategically, if the US were to annex Canada it would secure control over its strategic resources and better position military bases to meet Russia aggression in the Arctic region.

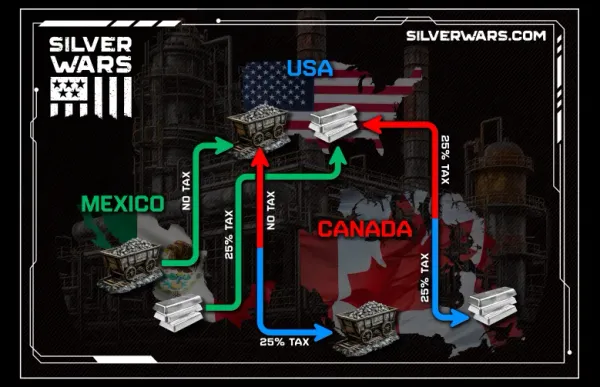

USGS recorded that the US imports approx. 18% of its silver needs from Canada (about 882 metric tons).

Russia's Ukraine Aggression Means Implications for the Arctic

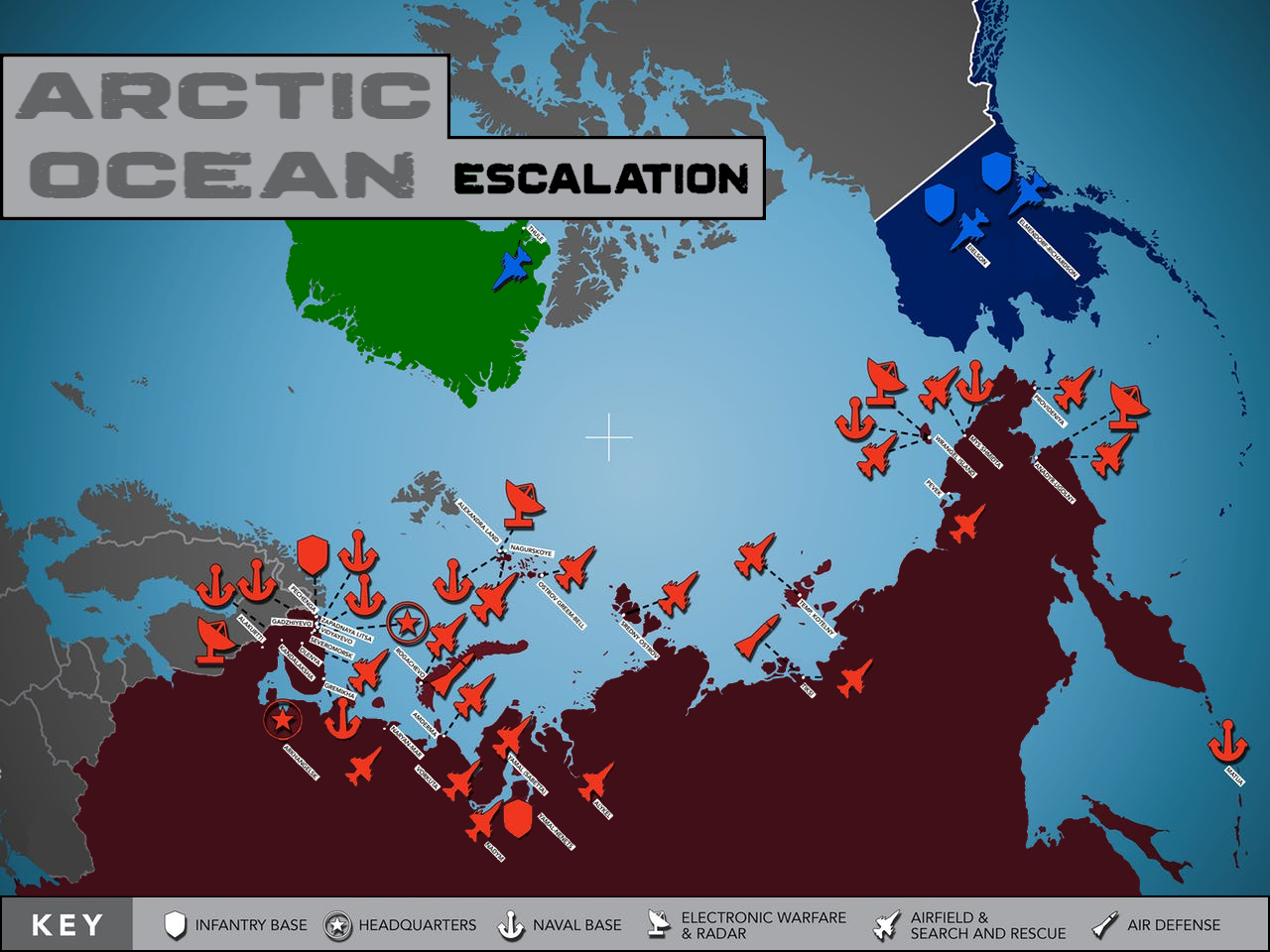

Russia has been quietly investing in Arctic military and industrial infrastructure for over a decade. The Northern Sea Route is their competing trade route through the Arctic to move good from China to the Europe to competitively cut down on existing trade routes with the goal of attracting financial and trade partnerships (BRICS + private sector interests).

Russia's expanded Arctic presence is part of President Vladimir Putin's efforts to elevate Russia's posture on the world stage. Russia has reopened Soviet military bases and expanded the navy's Northern fleet to patrol the route.

Russia's goals are to increase its military power in the region to enhance it's homeland defense and secure Russia's economic future by attracting international investment.

Several new ships and submarines have been commissions to join Russia's Northern Fleet, which is in command of the region. Lots of silver will be necessary to complete these orders.

Russia's Project 210, also known as the Losharik (deep ocean spy submarine), is preparing for a significant comeback after being sidelined due to a fatal fire in 2019 that claimed 14 lives.

The investigation of the incident revealed the batteries were the cause of the fire. The batteries were lithium-ion. The submarine is not designed to use lithium-ion batteries, but silver-zinc ones. The replacement of the batteries was a consequence of the war in Donbas, Ukraine.

Currently, Donbas is located within Russian occupied territory.

The Donbas region (Donetsk and Luhansk oblasts) in Eastern Ukraine is one of the largest old industrialized regions in Europe, with a high concentration of mining and heavy industry present. Despite being an old industrial center, it has benefited from a high level of investment in high-tech industries.

Donbas can be considered an eastern counterpart to regions in western Europe such as the Ruhr valley, which is notable for its silver deposits.

Occupying this territory gives Russia access to more silver to expand their military and aerospace capabilities which will be needed to counter and stay lockstep with the US as sights are set on controlling the new Arctic region.

At this time, it does not appear that Russia has been able to take full advantage of Ukraine's silver, likely due to on-going conflict in the occupied region.

Russia's silver production has dropped to the lowest point at just 1200 tons recorded in 2023. In comparison to nearly double that figure (2100 tons) produced in 2018.

Russia's silver reserves have seen a large increase since 2018. The USGS notes that Russia had an estimated 45,000 tons of silver reserves in 2018, and has jumped to a whopping 92,000 tons in 2023!

Russia has not "officially" annexed any new territories, so there is no definite answer as to why their silver reserves have doubled. However, the USGS may be considering the newly occupied Ukraine territories that Russia acquired since 2018 apart of Russia's total reserves now (Crimea, Donetsk & Luhansk (Donbas), Kherson and Zaporizhzhia oblasts).

To the Victor, Go the Ukraine Spoils

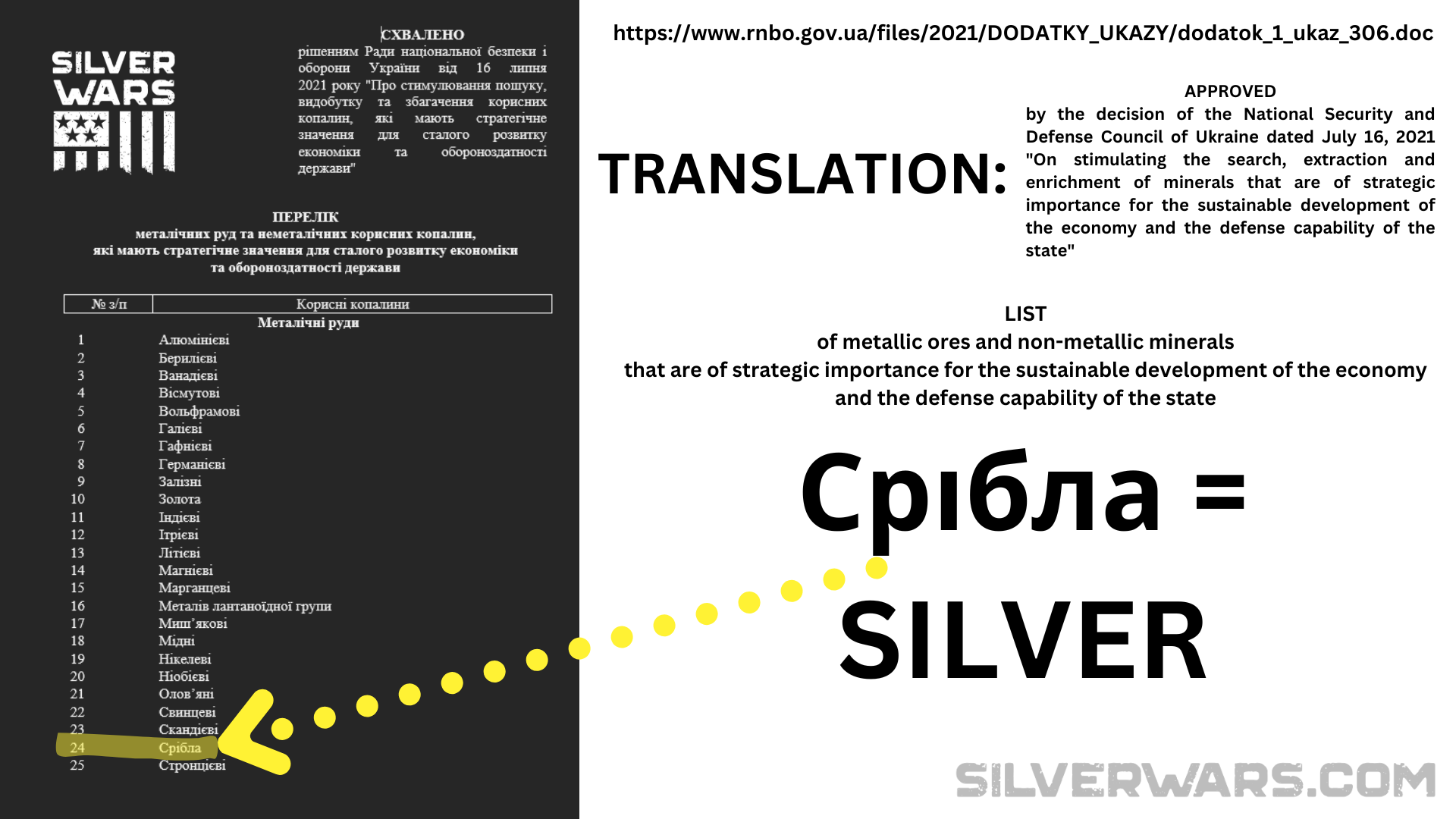

In 2021, the Ukraine Defense Ministry published a document listing key minerals that were of strategic importance for economic and defense capabilities of the state where they would be stimulating the search, extraction and enrichment of.

Silver is among the key resources listed.

Ukraine (so far) would uniquely be the only government known to consider silver a critical material, or at least disclose that they do.

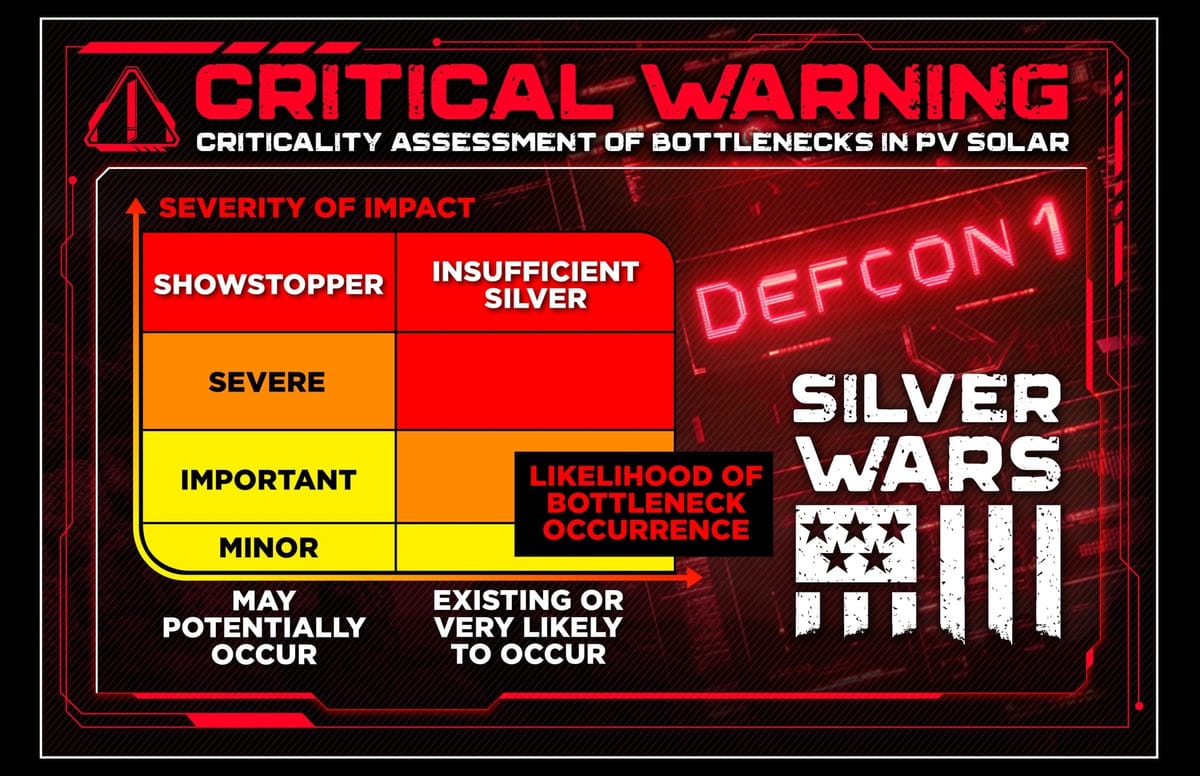

Our research suggests that silver has all the merits of a strategic and critical raw mineral. but has yet to be acknowledged as such by the US or other world superpowers, not at least publicly.

To maintain supply of a finite resource, it would not be in any superpower's interest to disclose how critical silver is to maintain its military power or its dependence on any one material for any reason. Except, its safe to say that silver is a problem shared by all superpowers today, and any country currently at war.

Before the war, the metallurgical industry was one of Ukraine's main export industries (along with defense related manufacturing), but since the war, exports have been in decline. Logistical routes have also been complicated due to blocked seaports and rail transport only able to replace part of the sea exports.

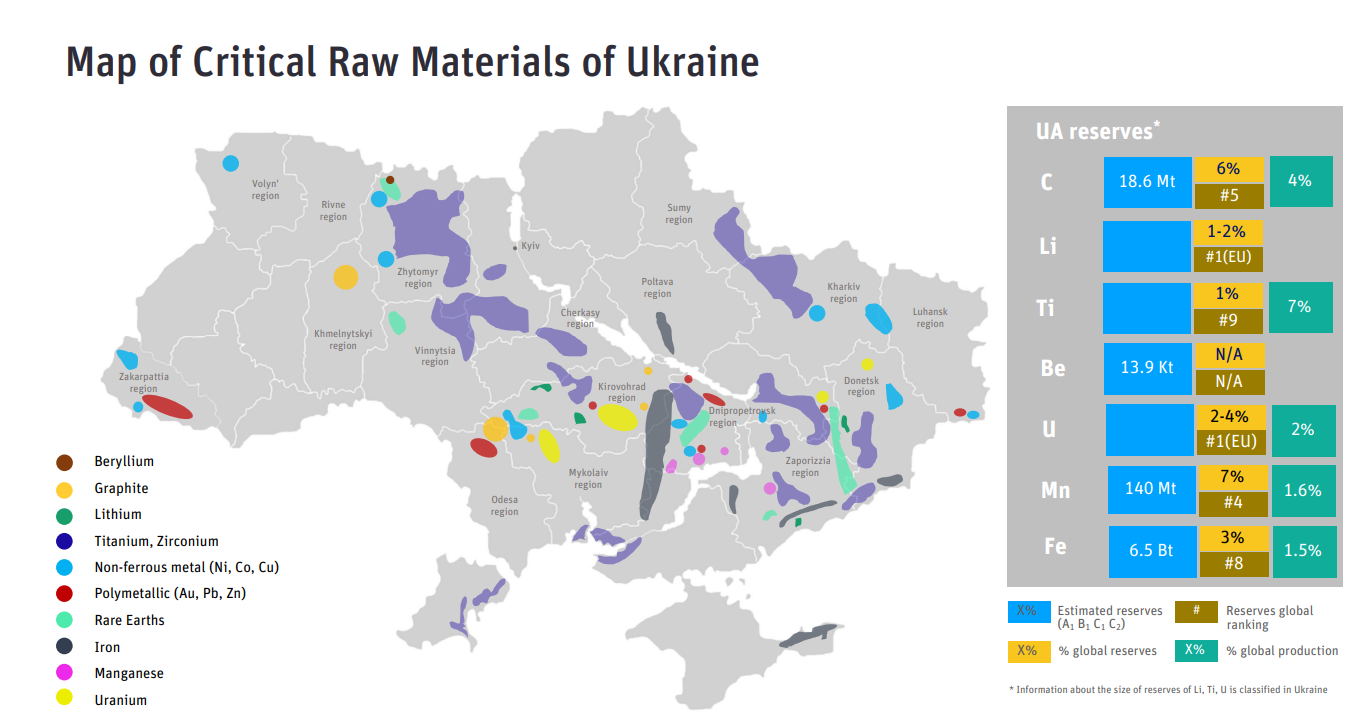

Ukraine have partnered with the USGS, US Department of Energy, European Bank for Reconstruction and Development, European Raw Materials Alliance, The Geological Survey of Europe and the European Commission to assist with documenting and for auctioning off its Critical Raw Materials to supply Western interests.

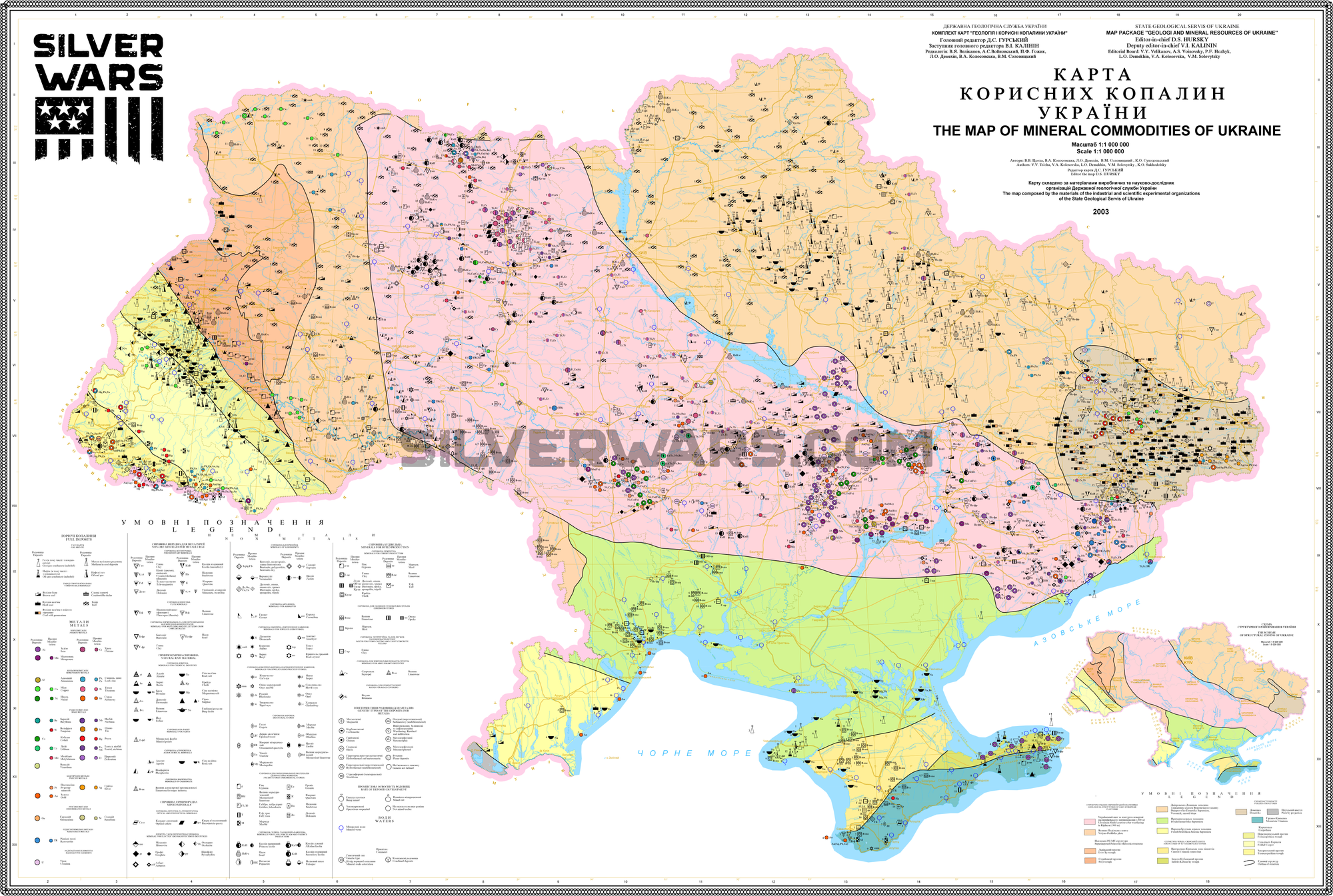

Notably, silver is not listed in the Mining Investment presentation directly, but it could be counted among the non-ferrous and polymetallic ores types that are referenced. As well as the large map in the section above.

According to the World Economic Forum, Ukraine holds significant reserves of nonferrous metals such as copper (4th in Europe), lead (5th), zinc (6th), and silver (9th).

Despite this, the USGS publications available to western investors completely omits reference to Ukraine's silver deposits, except for one mention under the section Gold in the 2016 report.

Three years after the initial conflict in Ukraine (2014), it was discovered that the Ministry of Finance of Ukraine involved western banking institutions such as J.P. Morgan and Goldman Sachs to raise investment capital to fund the country.

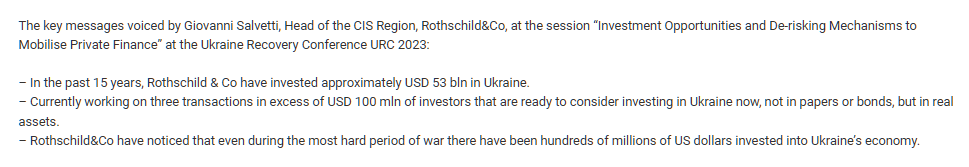

Rothschild & Co are mentioned as financial advisor to the Ministry of Finance of Ukraine.

Ukraine is rated B- by S&P and Fitch and Caa2 by Moody’s. BNP Paribas, JP Morgan and Goldman Sachs are acting as book-runners on investment deals.

Noted on UkraineInvest.gov.ua, Rothschild and Co have invested approx. 53 billion in Ukraine since 2008, which is 6 years prior to any conflict in the country.

The 18th-century Baron Rothschild is remembered to have said, "Buy when there's blood in the streets, even if the blood is your own."

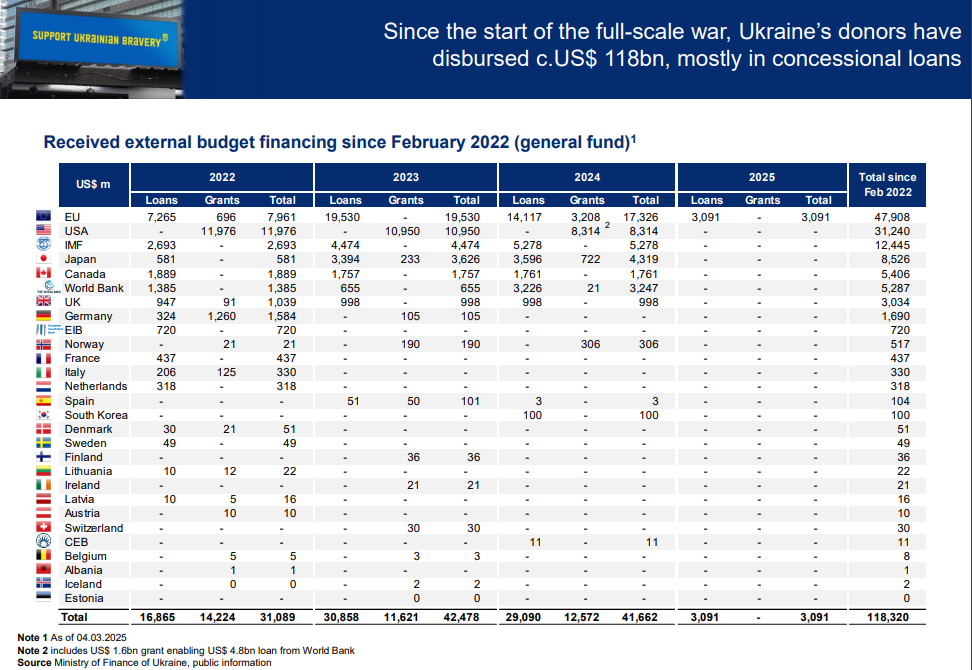

According to the latest budget data from Ukraine government website, the money its been receiving from foreign governments have mainly been in the form of concessional loans and grants.

A concessional loan is a subsidized debt with strings attached (repayment), while a grant is a non-repayable gift.

The US has disproportionately given more non-repayable gifts than other countries. These gifts have mainly come in the form of USAid, where conditions focus on controlling how these funds are spent.

Such as the Competitive Economy Program (CEP), which supports startups, small and medium enterprises, competitive industries on Ukrainian and international markets, fosters a better business enabling environment, and enabling Ukrainian companies to benefit from international trade.

Although the EU does give some financial aid in the form of grants, the majority of their aid to Ukraine comes with a catch, repayment.

If its to help with Reconstruction of Ukraine, the US is after something more important than money back. It wants financial benefit and control of Ukraine's natural resources.

The "Mineral Deal", an intergovernmental arrangement that Ukraine and the US are expected to sign that will place 50 percent of all revenues earned from the future monetization of all relevant Ukrainian government owned natural resource assets in a fund controlled between the US and Ukraine.

The language of the agreement defines natural resources as deposits of minerals, hydrocarbons, oil, natural gas, and other extractable materials and other infrastructure relevant to natural resource assets (such as liquified natural gas terminals and port infrastructure).

The Fund's investment process will be designed so as to invest in projects in Ukraine and attract investments to increase the development, processing and monetization of all public and private Ukrainian assets.

This will give the US the silver resources necessary to expand its ship building as noted as a desire of the Trump administration during his recent State of the Union address. This ambition will likely empower America's attempt to dominate the Artic region in the coming decade.

The Jewel of the Arctic

Much is unknown beneath the snow of Greenland, but what is known has the interests of world powers around the globe; its strategic resources.

Very little is known about the vast amounts of resources that could be available, but certain geological considerations may suggest its a bonanza waiting to happen!

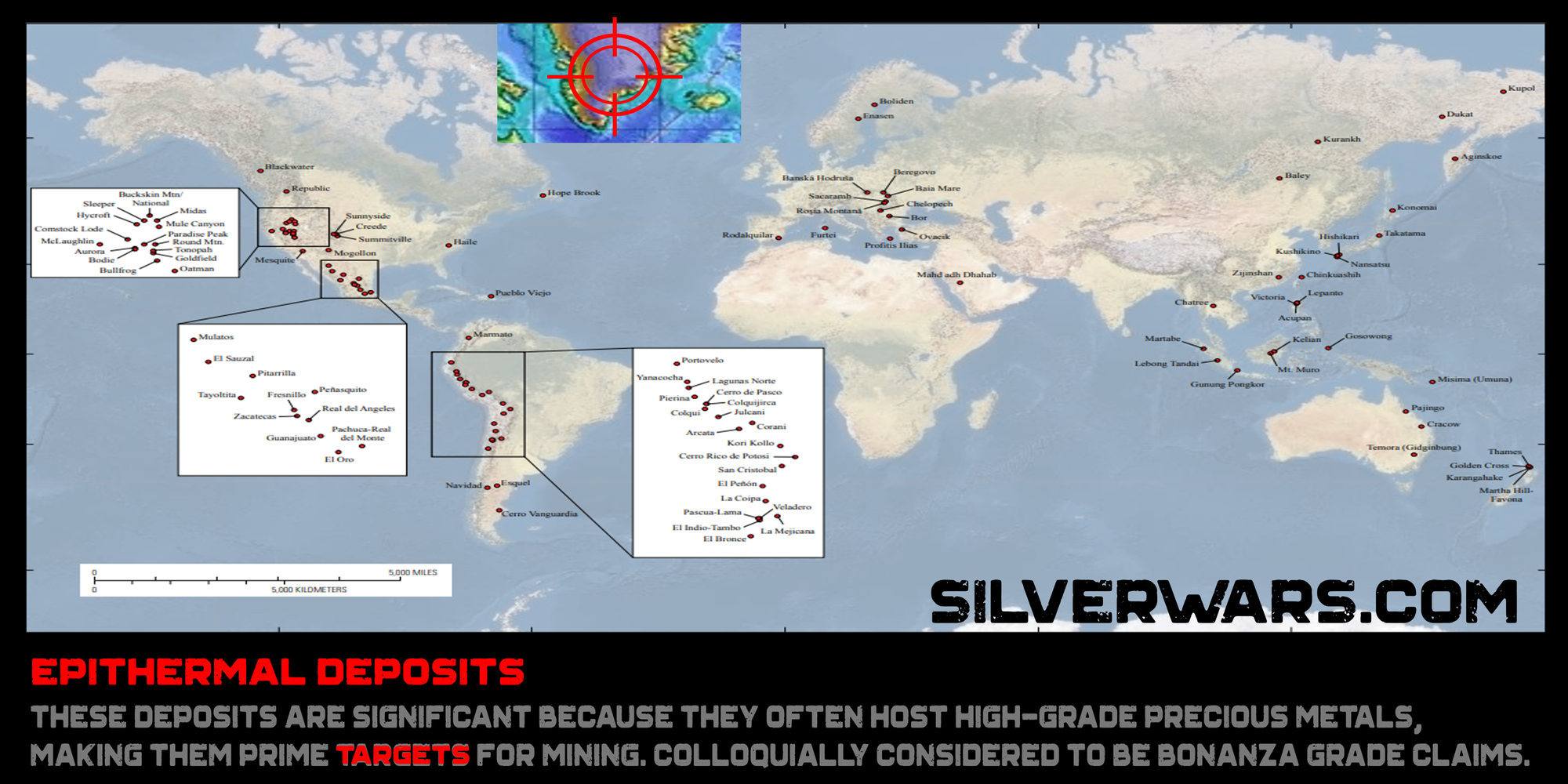

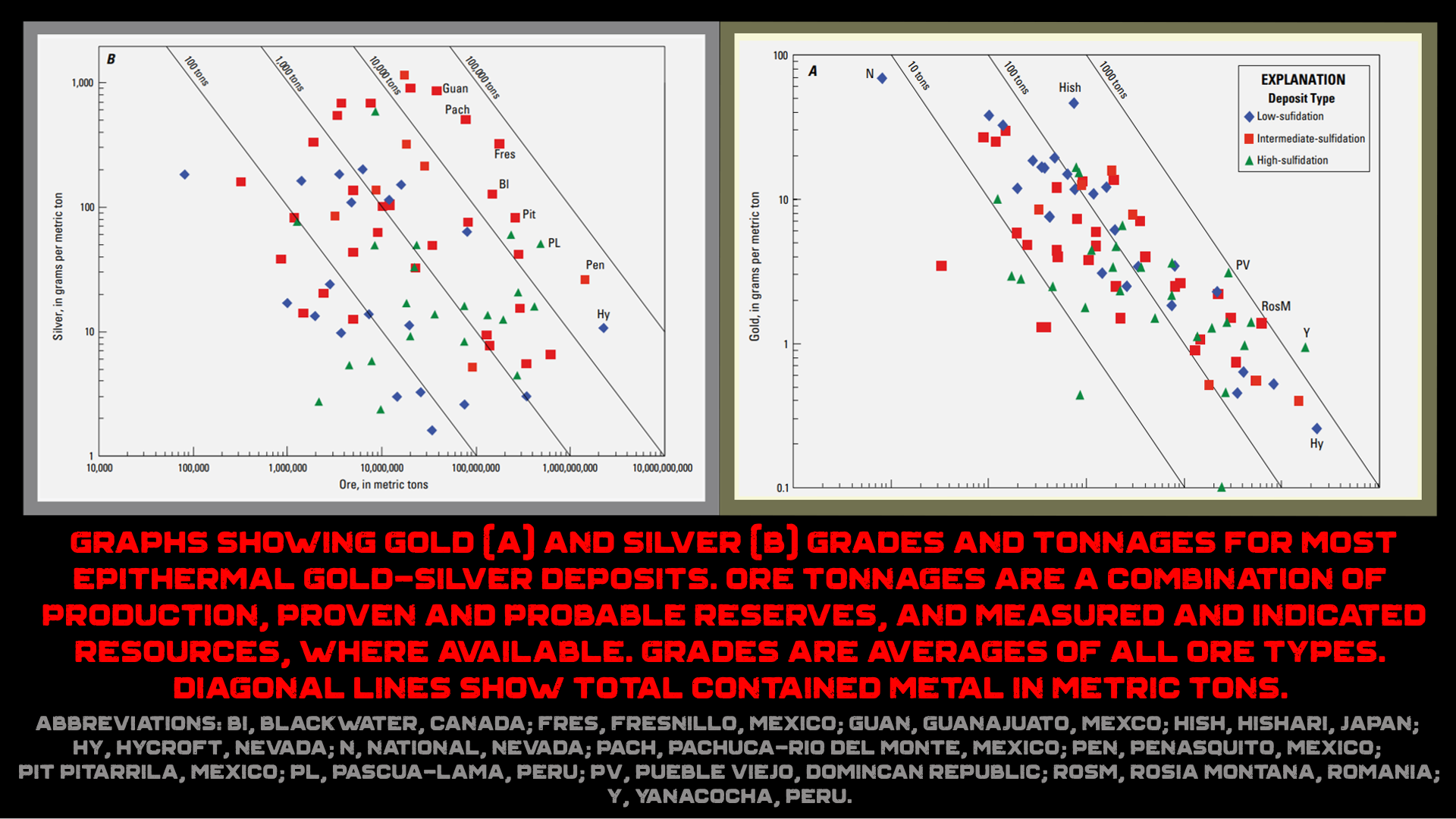

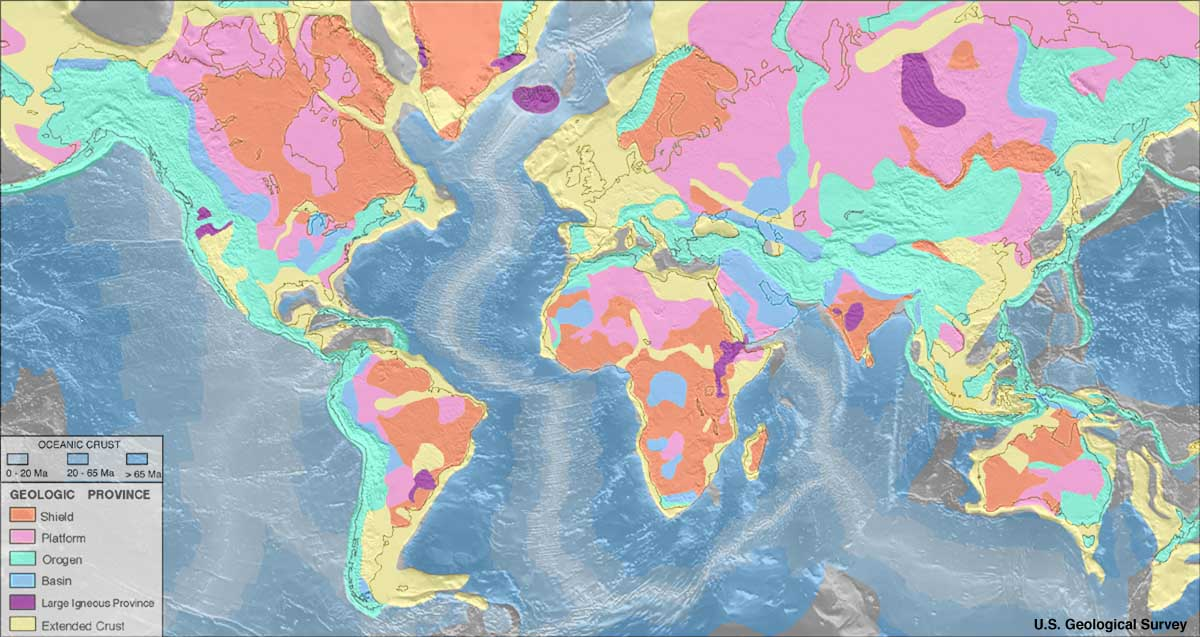

Greenland is classified as the largest island in the world and uniquely home to both epithermal and orogenic deposits of gold and silver.

One well-documented epithermal deposit has been identified in Greenland.

Research published by the Geological Survey of Denmark and Greenland (GEUS) highlights massive sulfide mineralization in oil-impregnated Palaeogene volcanic rocks on the West side of Greenland (Ubekendt Ejland). The occurrence is associated with volcanic activity and suggests the presence of epithermal-style mineralization.

Greenland's geological settings, particularly in areas like the Palaeogene volcanic provinces of West Greenland and the East Greenland rift systems, is conductive to epithermal deposit formation.

These regions feature volcanic rocks and fault systems that could host hydrothermal activity. However, no exhaustive survey specifically tallying epithermal deposits across the entire island has been done as of 2025.

Data from USGS shows a large orogenic geology is concentrated on the eastern side of Greenland.

The combination of these geological considerations has attracted the attention of the private sector and superpowers for the bonanza grade precious ore potential.

In 2022, research geologists from the USGS partnered with DARPA to challenge academia and the private sector to find ways of using artificial intelligence and machine learning to examine decades old or even centuries old geological maps and other statistical data to better locate critical resources.

A mining firm backed by Jeff Bezos and Bill Gates, KoBold Metals has been drilling in Greenland for critical materials since 2022. KoBold uniquely uses artificial intelligence and machine learning to hunt for raw materials. In 2021, the company secured a 51% stake in the Disko-Nuussuaq project on Greenland's west coast.

As more discoveries are made, so too will more eyes and special interest will be attracted to Greenland in acquiring the necessary and in short supply strategic resources, like silver to bring forth the high-tech age.

Preventing A New Trail of Tear

Greenland’s population is predominantly Inuit, with approximately 88% of its roughly 56,000 residents identifying as Greenlandic Inuit, or Kalaallit, as of recent estimates.

These indigenous people are descendants of the Thule culture, which migrated to Greenland around 1000–1100 CE from what is now Canada. The Inuit have adapted to the harsh Arctic environment over centuries, relying on subsistence hunting, fishing, and, more recently, commercial industries.

Ethnographically, they are divided into three main groups—the Kalaallit of West Greenland, the Tunumiit of East Greenland, and the Inughuit of the north—each with distinct dialects of the Greenlandic language, Kalaallisut.

Despite Danish colonial influence since the 18th century and Greenland’s status as a self-governing territory within the Danish Realm since 1979, the Inuit maintain a strong cultural identity and an ongoing movement for greater autonomy or full independence, driven by desires to control their land and resources, including zinc, diamonds, gold, silver, uranium, oil, and rare earth minerals.

Like Native Americans, both share a resilience against colonial pressures and a struggle to preserve sovereignty over their lands and resources.

The specter of a new Trail of Tears looms as global superpowers, including the United States and it's opposition, eye Greenland’s critical resources amid growing geopolitical ambition.

U.S. interest in annexing Greenland was first revived by President Trump’s former administration in a 2019 proposal and echoed today in political rhetoric is attempting to undermine Inuit self-determination.

Greenland’s bounty of strategic minerals and oil, vital for technology and energy, makes it a prize for special interest groups and nations seeking dominance in a resource-scarce world. A forced takeover or economic coercion could parallel the Native American experience, where land was expropriated under the guise of national interest, as seen with the Indian Removal Act of 1830.

For the Inuit, this might not mean physical relocation but could involve loss of control over their territory, environmental degradation from mining, or displacement from traditional lands due to industrial projects—echoing the cultural and economic devastation of the original Trail of Tears.

As climate change further exposes Greenland’s resources by melting ice, the tension between indigenous rights and superpower ambition intensifies, raising the stakes for a modern parallel to historical injustices.

Additional Sources:

https://pubs.usgs.gov/sir/2010/5070/q/sir20105070q_figA1.pdf

https://www.geo.gov.ua/wp-content/uploads/2021/01/MAISKA_license.pdf

https://www.geo.gov.ua/wp-content/uploads/2021/01/BALKA_SHYROKA_license.pdf

https://www.geo.gov.ua/wp-content/uploads/2021/01/KVITKIVSKA_license.pdf

https://www.geo.gov.ua/wp-content/uploads/2021/01/VERBYNSKA_license.pdf

https://www.geo.gov.ua/wp-content/uploads/2020/05/MRU_1_2020.pdf

https://mof.gov.ua/storage/files/Ukraine%20-%20Launch%20Announcement%20(Eurobonds).pdf

https://archive.ph/c6TDp#selection-8613.172-8613.251