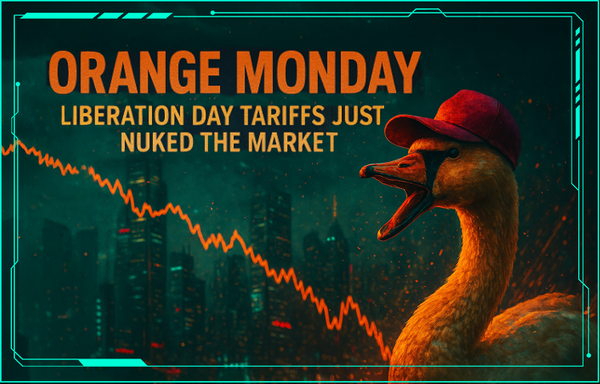

April 7, 2025: The Day a Shitpost Moved the Market

Picture this. The global economy is in full-on tariff freakout mode. President Trump is dropping trade bombs like he’s trying to win a Call of Duty killstreak. Countries are throwing tariffs around like candy at a parade. Markets are panicking, big money is crying, and every trader on Wall Street is glued to social media praying for one—just one—shred of good news.

So what happens?

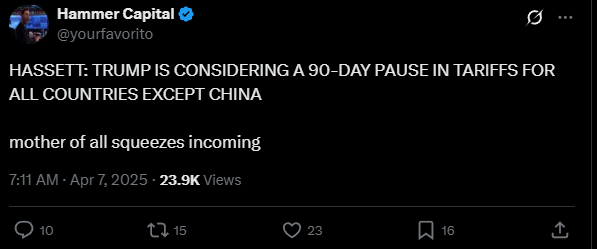

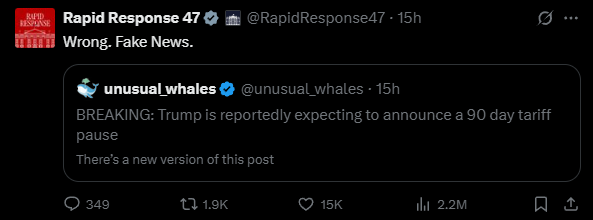

Some rando with an $8 blue checkmark on Elon’s Discount Twitter posts a fake leak. Not a press release. Not a White House statement. Just a post that says, “Trump is considering a 90-day tariff pause for all countries except China.”

HASSETT: TRUMP IS CONSIDERING A 90-DAY PAUSE IN TARIFFS FOR ALL COUNTRIES EXCEPT CHINA

— Hammer Capital (@yourfavorito) April 7, 2025

mother of all squeezes incoming

Yes, this random account setoff the massive unverified news that rocked the market today.

Boom.

The market explodes. We're talking multi-trillion-dollar swings here. CNBC runs with it. Reuters echoes it. By the time the White House says “LOL no,” it's too late. The rollercoaster has already left the station, and the entire financial sector is just holding on for dear life.

The Hunger for Hope: Why the Market Bit

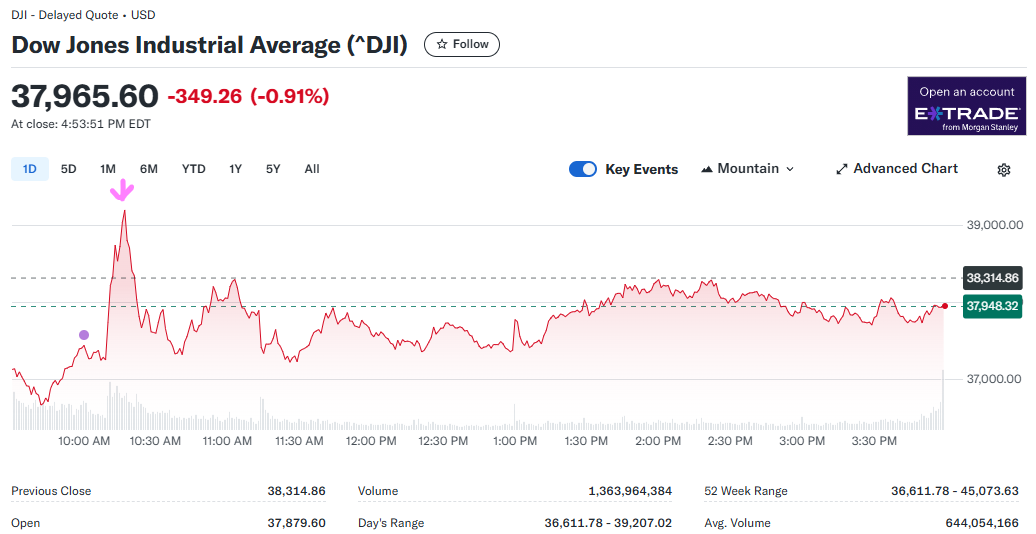

Before we get to the absolute clown show of how this all unfolded, you have to understand the desperation here. The markets are cooked. Trump's tariff policies have caused the worst one-day drops in years. We’re talking about index charts that look like someone fell down the stairs with a crayon.

So when some digital nobody says, “Actually, Trump might ease off,” everyone collectively loses their minds and starts buying like it's 2009 again. Why? Because they want to believe. They need to believe.

Table: Market Reaction Timeline (April 7, 2025)

10:11 AM

HASSETT: TRUMP IS CONSIDERING A 90-DAY PAUSE IN TARIFFS FOR ALL COUNTRIES EXCEPT CHINA

— Hammer Capital (@yourfavorito) April 7, 2025

mother of all squeezes incoming

10:13 AM

10:15 AM

It Only Took 4 Minutes for MSM to Start Spreading this Fake News.

10:17 AM

10:19 AM

10:21 AM

10:24 AM

This is what happens when journalism is replaced with vibes and social media engagement is mistaken for credibility.

The Snake Eats Itself

Twitter is such garbage that its making multi Trillion Dollar Market moves based on "Engagement Farming." The Internet Is Dead and Twitter is killing it faster...

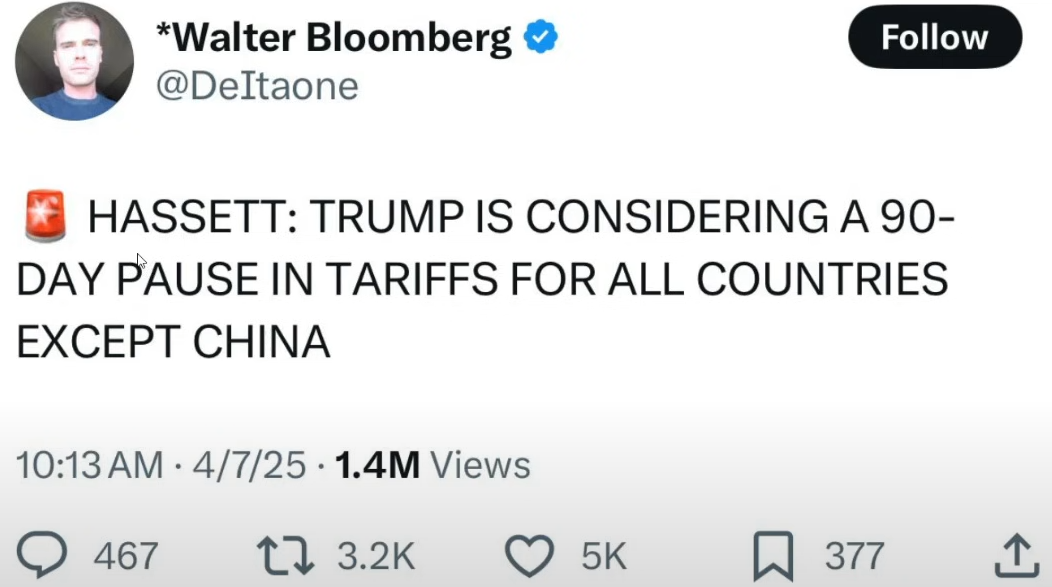

Let’s talk about Ouroboros—the ancient symbol of the snake eating its own tail. That’s what this entire news cycle was. One fake post from Hammer Capital. Another fake post from a blue check ad-revenue guy pretending to be Bloomberg. Then CNBC goes live with it. Reuters publishes an alert citing CNBC. And THEN Twitter accounts start saying, “Oh, Reuters is our source.”

No, YOU were the source.

It’s one giant disinformation circle-jerk with trillions of dollars on the line. Nobody verified anything. Everyone just wanted the market to go up because they were bleeding money. And when it finally blew up in their faces? Crickets. No accountability. No consequences.

Twitter Is Just a Glorified Scam Machine Now

Let’s not pretend this happened in a vacuum. Twitter—or “X” if you’re still pretending to take Elon’s rebrand seriously—is a garbage fire of misinformation now. The blue check is meaningless. It's an $8 badge that says, “Yes, I will lie to millions of people for a nickel of ad revenue.”

The platform is crawling with scam bots, psyops, wannabe influencers, and now apparently part-time market manipulators. And the mainstream media? They’re not better. They’re worse, because they’re amplifying the noise. CNBC didn’t verify. Reuters didn’t verify. They just wanted to be first. So they repeated a lie and sent the stock market into a frenzy.

At this point, Twitter is like a glitchy Bloomberg terminal for sociopaths with no credentials.

No One Will Be Held Accountable

Let’s not kid ourselves. There will be no criminal investigation. No SEC crackdown. Hammer Capital and “Walter Bloomberg” will keep tweeting. CNBC will keep pretending they didn’t screw up. Reuters will move on. And the next time a troll tweet can juice the market, everyone will pretend they weren’t burned before.

Because we live in a circus.

A circus run by disinformation profiteers, boosted by lazy reporters, and cheered on by desperate investors who just want the bleeding to stop.

The Silver Wars Continue...

If this story doesn’t convince you we’re through the looking glass, I don’t know what will. The economy is running on vibes. Financial journalism is playing telephone. Twitter is a weapon. And tariffs—yes, tariffs—have become the speculative equivalent of heroin for the stock market.

If you think news on Silver isn't being suppressed (especially by the Techno Nepo Baby Elon), you need to get out of the metals news biz. No seriously, your doing more harm than good and the Silver stacking Apes won't be fooled by your scams/psyops anymore. Silver is the Achilles heel to this whole garbage fire of a financial system and fuels the large majority of the weapons of war.

Someone once said, “A lie can travel halfway around the world while the truth is still putting on its shoes.” On April 7, 2025, the lie rode a rocketship—and the truth got trampled trying to catch up.