Data is showing a new Gold to Silver ratio is forming, 4:1, but its not what you might think.

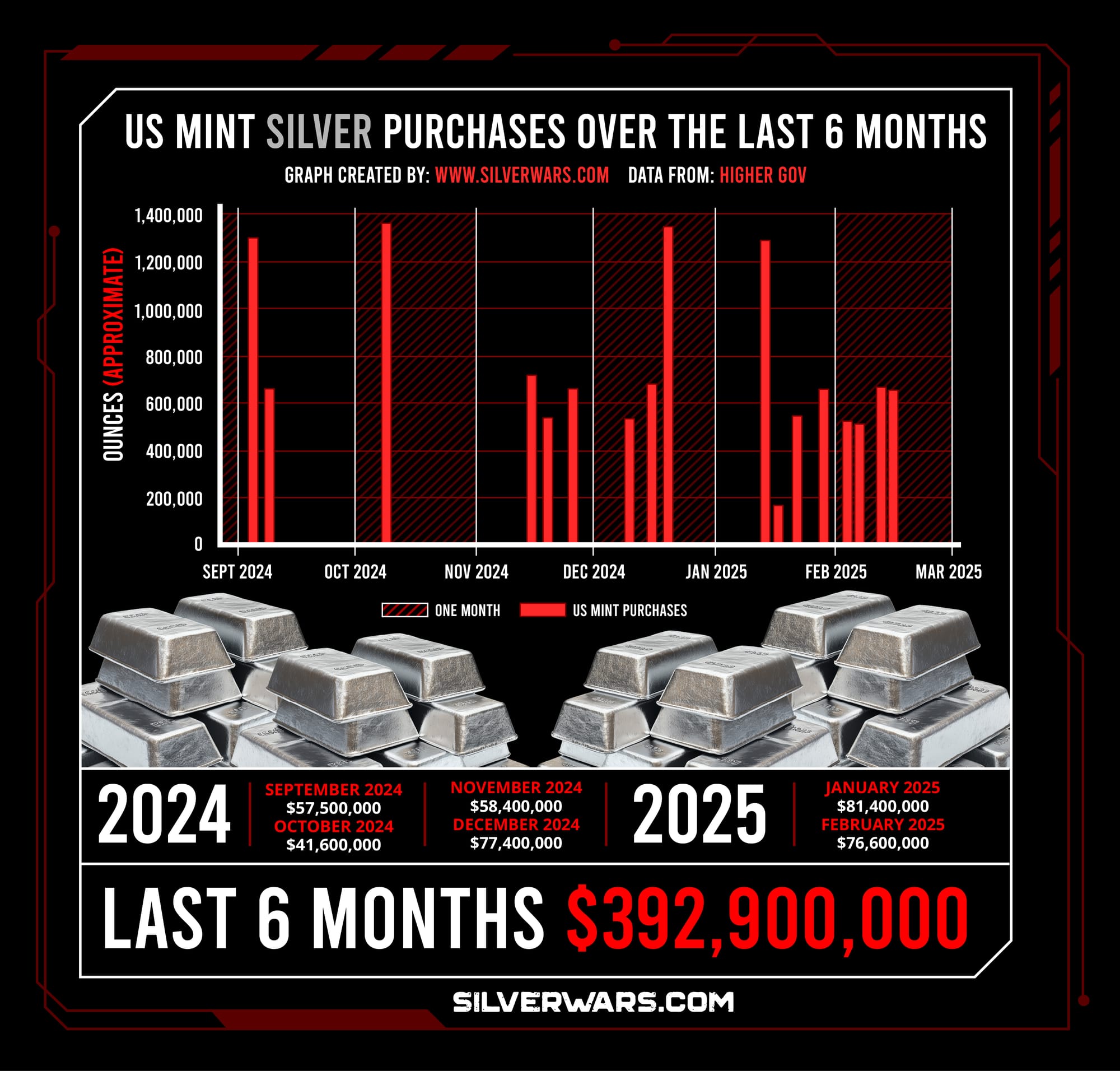

The US Treasury has spent nearly $400m for raw silver bullion from London, compared to only around $120m for gold in the last 6 months, with February on track to be a record buy month for silver.

The US government is purchasing the metal as RAW Bullion through the US Mint's Silver & Gold Bullion Funds from a company called StoneX. Each contract notes the "Place of Performance" or origin of the purchase as the United Kingdom.

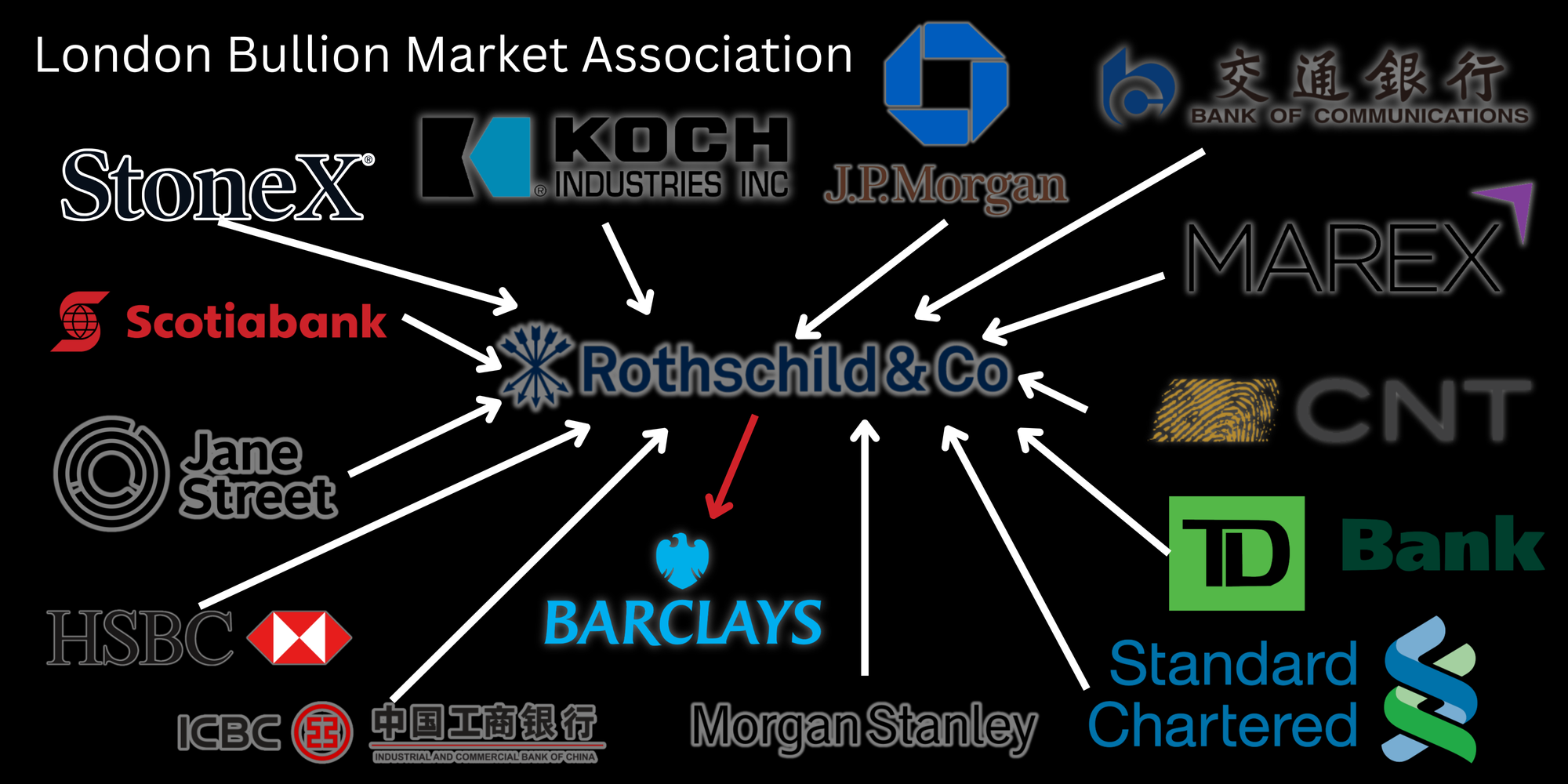

StoneX is a member of the London Bullion Market Association, as well as:

- Clearing and Execution Members of the CME

- London Platinum & Palladium Market Association

- Singapore Bullion Market Association

- Dubai Gold and Commodities Exchange

StoneX is the rebrand (2020) form of British company INTL FCStone Inc, a Fortune 100 financial services company that connects clients to global markets. They are one of 14 participants in the London Gold Fixing. Along with...

- Bank of China

- Bank of Communications

- Industrial and Commercial Bank of China

- Coins 'N Things

- Jane Street Capital

- HSBC Bank USA

- JPMorgan Chase

- Koch Supply and Trading

- Marex Financial

- Morgan Stanley

- Standard Chartered

- Bank of Nova Scotia

- Toronto-Dominion Bank

The London Gold Fixing (or Gold Fix) is the setting of the price of gold that takes place via a dedicated conference line. It was formerly held on the London premises of Nathan Mayer Rothschild & Sons by the members of The London Gold Market Fixing Ltd. While not mentioned by name, the fix also includes silver.

In 2004, N.M Rothschild & Sons claimed to have stepped away from gold trading and the fixing to give their place to Barclays Capital and the chairmanship position formerly held permanently by Rothschild, now rotates annually.

However, there may only be a thin separation between the interests of Rothschild and Barclays as the group's chairman, Nigel Higgins, is a former Rothschild banker.

Over the last 6 months, the US government (as part of a larger parent $10B indefinite delivery contract) has purchase nearly $400M or 12.3M ounces of Raw Silver Bullion from the UK through StoneX.

This month (Feb) is on track to be the largest so far with 2.37M ounces of silver already being purchased.

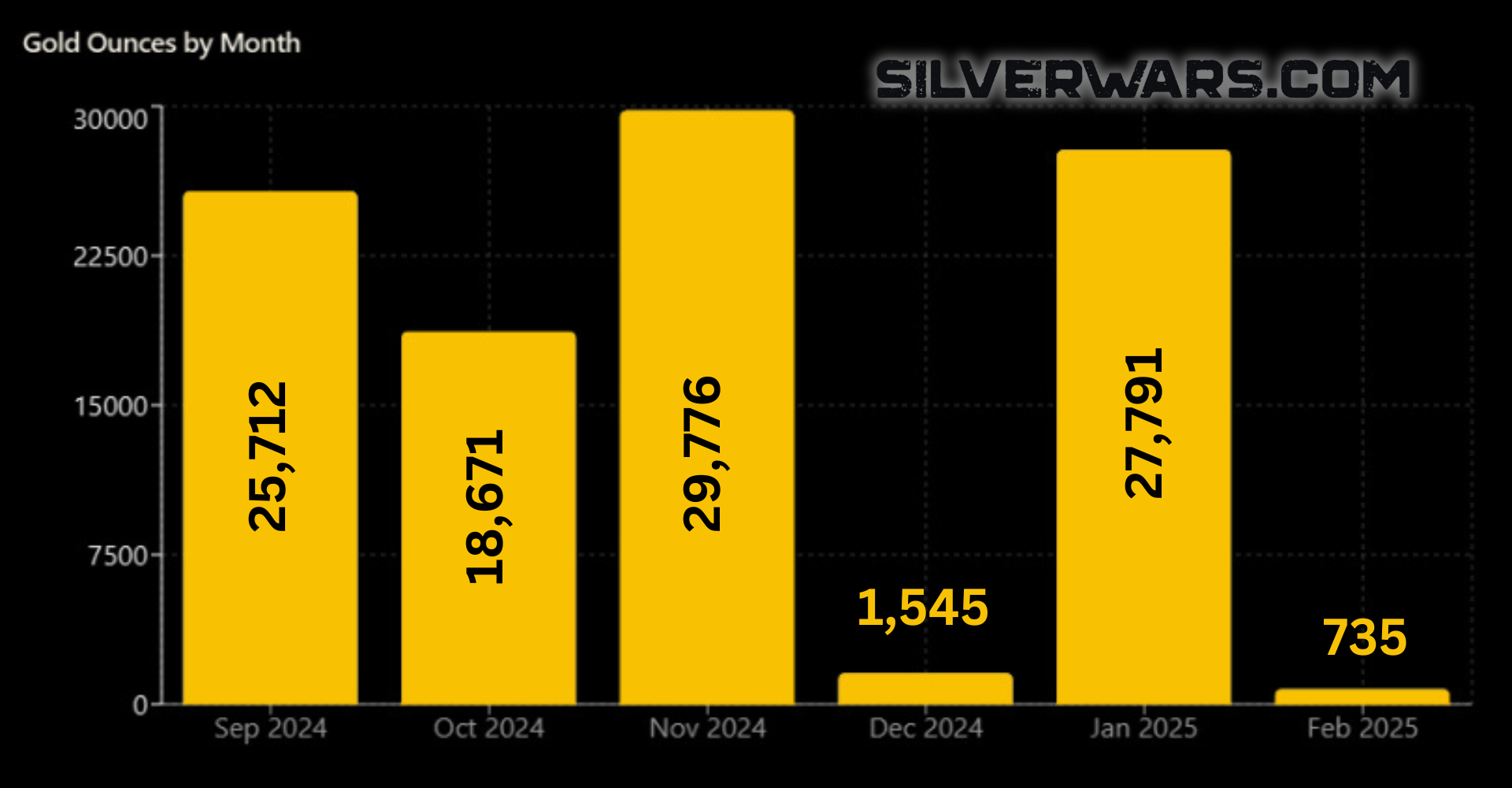

When looking at Raw Gold Bullion, the same purchasing enthusiasm just isn't there. Its in fact, abysmal.

The US government has only committed $120.5M for about one hundred thousand ounces of gold over the same time period. This month (Feb) only about seven hundred ounces of gold were purchased from London so far.

Rumors have recently spread that due to a speculative audit of Fort Knox by DOGE, the US is secretly buying up gold to cover what speculators believe is missing from the holdings. A sum 147.3 million ounces of gold is expected to reside there.

By its actions to purchase so little gold this month, the US government is not concerned with its gold holdings. The strength of the US would be severely undermined by any lack of gold. So, the audit will either find the perfect amount, or not happen at all.

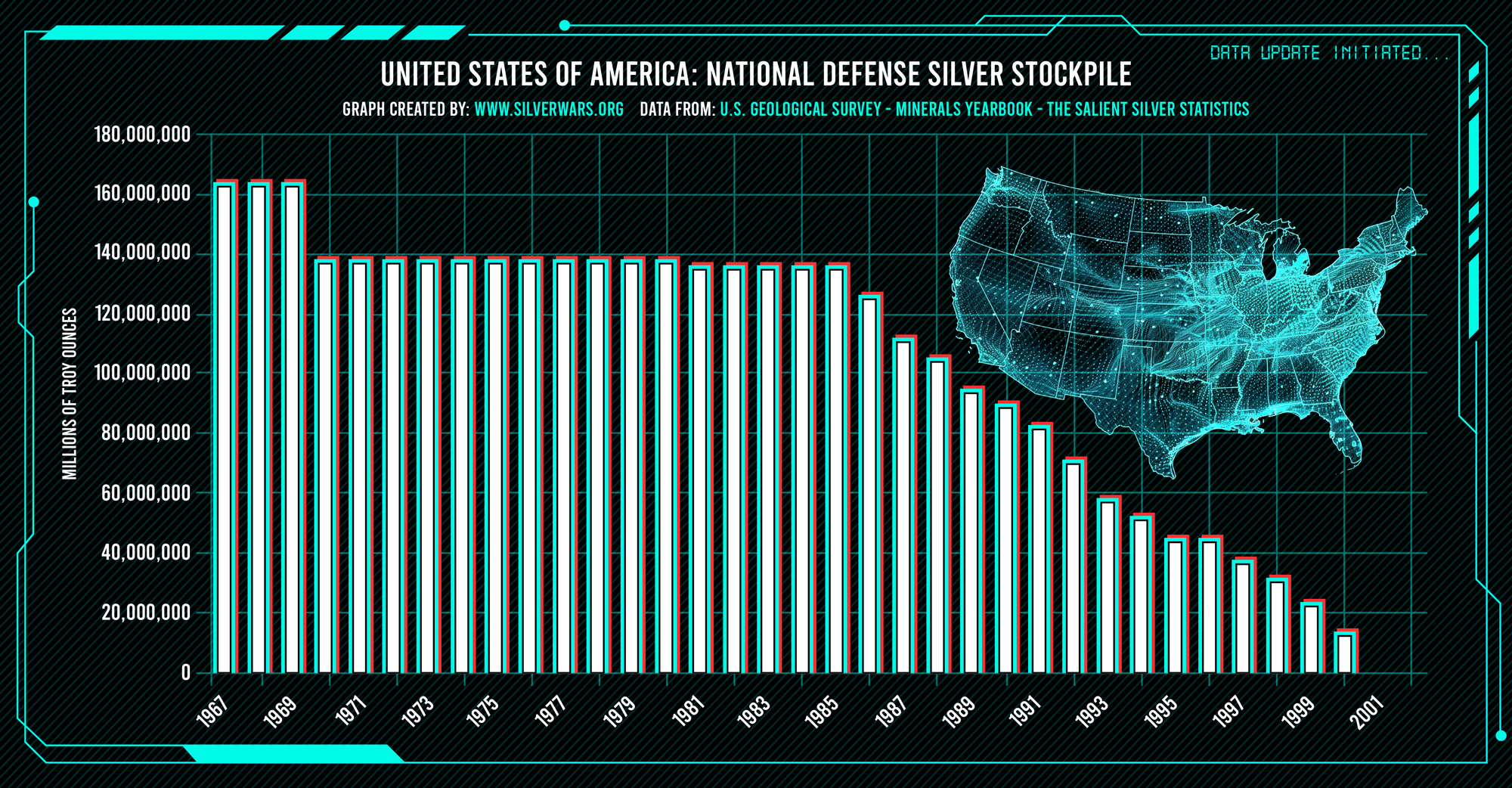

There is no silver to account for in Fort Knox. There is no strategic stockpile that would otherwise be held by West Point. There are no military stockpiles at the Defense Logistics Agency beyond what is scrapped internally by the Department of Defense.

Additional comments from London regarding gold delivery delays have also driven the market, along with the Trump Tariffs sparking the idea of a trade wars and speculation of rehypothecation among precious metals analysts.

There is no industrial shortages of gold, but the same cannot be said of the growing concern for silver.

As we previously reported, the world is at a critical point for the silver supply. The photovoltaic industry (solar) alone is expected to use up all know reserves by 2050, and emphasis needs to be made that this is just one industry that relies on silver. Many sectors are growing, especially those further driving the silver demand, such as EVs, Ai, medical, aerospace and the defense industries.

We believe the enthusiasm for gold is misplaced and being inorganically nudged along. The likelihood there is a psychological operation underway is high.

The objective would be to shake metal out of the hands of the silver investor (above ground reserve), incentivizing the wealth be placed in gold instead.

Its time for the retail investor to wake up and recognize silver as the clear choice, otherwise the Military Industrial Complex will gobble up what it can and leave the scraps to industry, and then there may not be anything left.

There are no alternatives to the best metal for electrical conductivity.

According to TechSci Research's report, "Military Battery Market – Global Industry Size, Share, Trends, Competition Forecast & Opportunities, 2029F", the global military battery market reached USD 4.54 billion in 2023.

This report expects the market to reach 6.84 billion by 2029.

The defense sector has seen an overhaul in recent years, with increasing reliance on advanced electronic systems to enhance effectiveness. Batteries play a critical role in powering defense equipment, ranging from communication devices to unmanned vehicles and precision guided munitions.

Silver is playing a crucial role for the defense sectors around the world and for many usages, especially for aerospace, naval and nuclear, silver remains an unreplaceable and by all scientific means, a critical mineral.

Only time will tell if the average person has the courage and ability to withstand the onslaught of false narratives to distract and nudge them away from silver.

As the data is concerned, don't fall into the 'gold trap' and remember the evidence shows Uncle Sam believes in spending his money in a ratio of four times the silver to gold.

(US Treasury Data Source)