Let’s cut through the bs and get to the heart of the matter: the precious metals market is not some free, open marketplace where supply and demand work in harmony. Instead, it’s a carefully orchestrated, rigged game where the players—the banks, the government, and the so-called market makers—manipulate every aspect of gold and silver trading to serve their own interests. If you’ve ever wondered why the gold price seems so disconnected from reality or why the so-called “price discovery” process is shrouded in mystery. We’re going to expose how the COMEX and LBMA are colluding to create a system that benefits the insiders at the expense of the average investor.

The Real Deal Behind COMEX and LBMA

What Is COMEX, Really?

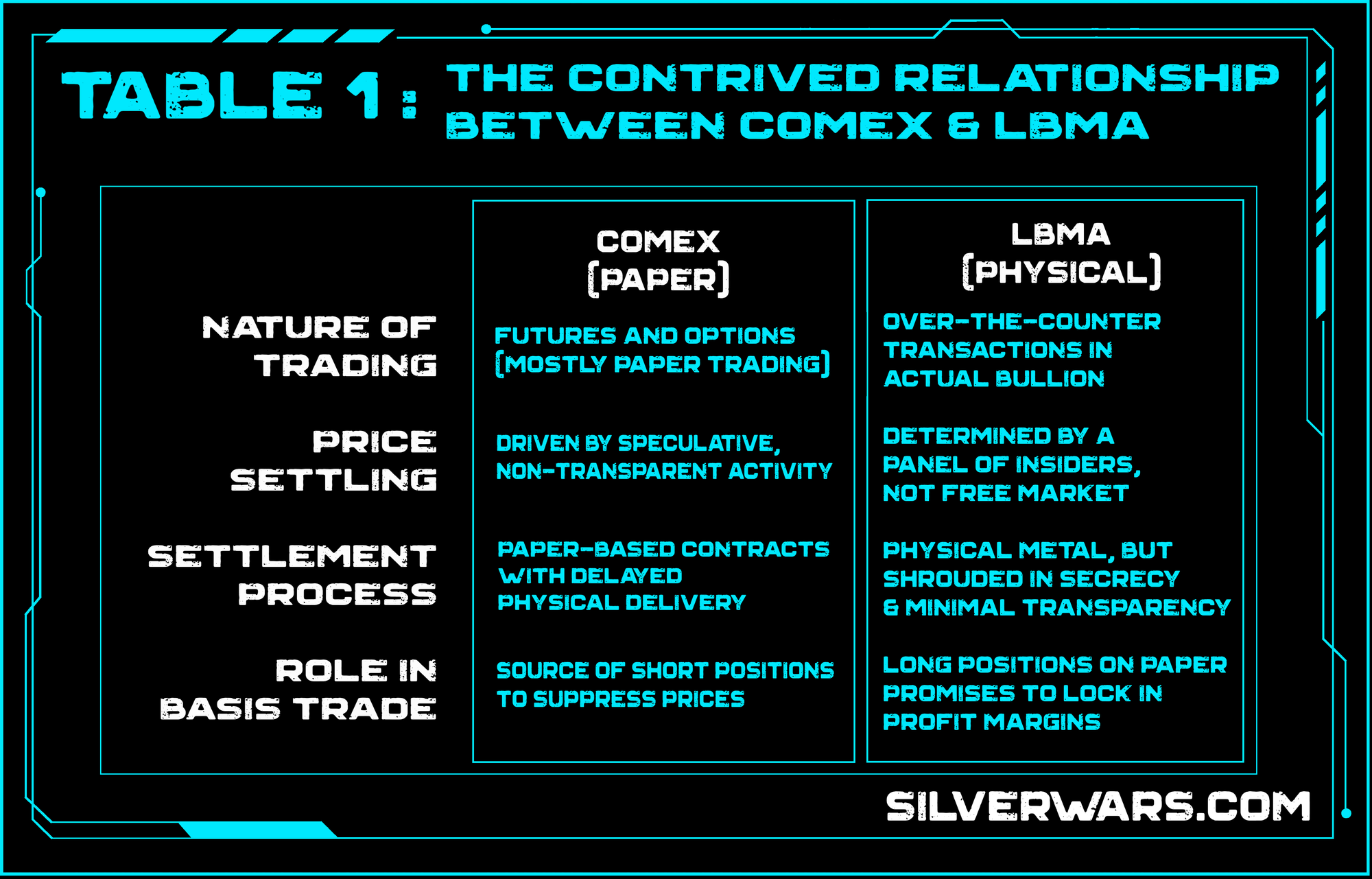

The COMEX is the poster child for paper trading. On the surface, it’s the marketplace where traders buy and sell futures contracts for precious metals like gold and silver. But don’t be fooled: most of what happens on COMEX is not about moving physical metal. It’s about creating massive paper positions that have little to do with the tangible asset itself. Think of it as a giant casino where the chips aren’t backed by real cash—they’re just a promise, a contract that never results in a physical exchange.

Key points about COMEX:

- Futures and Options: Traders bet on future prices, not the physical metal.

- Paper Trading: The vast majority of transactions are merely promises, not physical transfers.

- Delivery Mechanism: Sure, you can take delivery of gold or silver, but only if you’re willing to navigate a labyrinth of paperwork and opaque processes.

The LBMA: The Front for Physical Bullion

On the other side of the coin is the LBMA (London Bullion Market Association). Unlike COMEX, the LBMA deals with the physical metal—real gold and silver stored in vaults. But here’s the kicker: the LBMA is not the transparent, free market one might expect. It’s an over-the-counter (OTC) market, meaning that it’s far less regulated and far more secretive than its COMEX counterpart.

Key points about the LBMA:

- Physical Trading: The LBMA handles actual gold and silver, but the details are kept under tight wraps.

- Price Fixing: The LBMA price fix, formerly known as the London Gold Fix, is determined by a panel of insiders who set the benchmark prices not through market forces, but through mutual agreement.

- Custodianship: Physical bullion is stored in vaults, often controlled by major banks, further consolidating power among the financial elite.

The Dirty Tricks: Basis Trading and EFP Manipulation

The Basis Trade: A Setup for Institutional Profit

Let’s be blunt: the basis trade is the cornerstone of this rigged system. Here’s how it works. Banks and large financial institutions take massive short positions on COMEX futures while simultaneously holding long positions on LBMA paper promises. In other words, they bet that the COMEX price will remain artificially lower than the LBMA’s physical price. This deliberate mismatch creates an arbitrage opportunity that allows them to extract profit continuously—no matter what the actual supply and demand for gold or silver might be.

The basis trade is not about speculating on the future price of gold or silver—it’s about ensuring that the system remains profitable for those who control it. The banks are not taking a stance on whether gold should be higher or lower; they’re just reaping the rewards from the spread between the COMEX and LBMA prices.

EFP: The Exchange for Physical – A Tool for Concealment

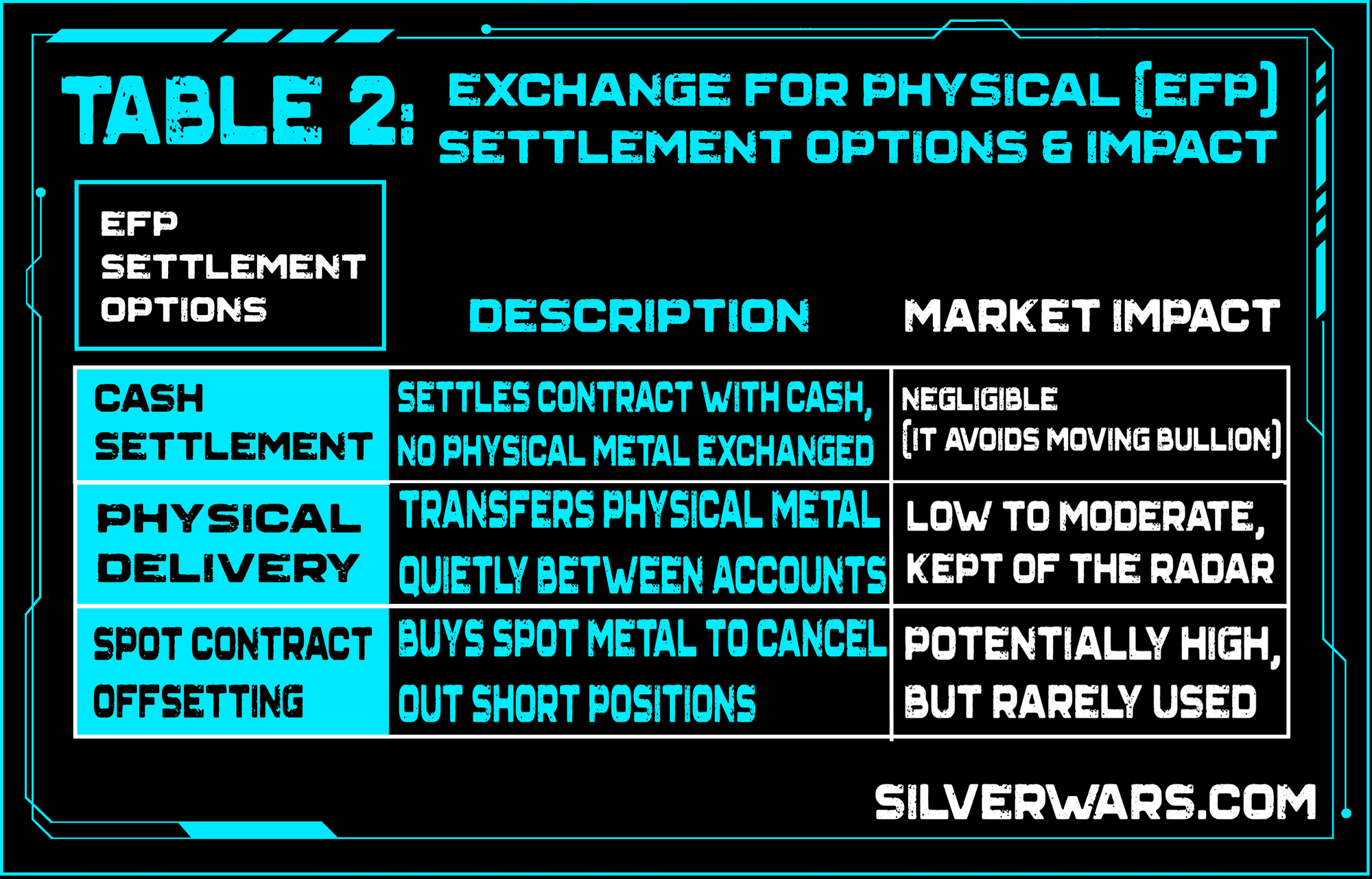

Enter the EFP (Exchange for Physical) mechanism, a seemingly benign process that, in reality, is a masterstroke of market manipulation. The EFP allows these institutions to settle their paper contracts by “exchanging” them for physical metal without actually moving the metal in a transparent way. It’s an off-exchange settlement method that lets the insiders maintain the status quo without drawing public attention to their massive positions.

There are several ways they use EFP:

- Cash Settlement: Instead of moving the actual metal, the contract is settled in cash. This minimizes any impact on the market and keeps the physical metal locked away.

- Physical Delivery via EFP: In rare cases where physical metal is required, the EFP mechanism is used to shift bullion between accounts in a way that leaves prices largely unaffected.

- Spot Contract Offsetting: For those moments when the market demands a physical exchange, the institutions can cancel out their short positions by purchasing spot metal—a process that, if done openly, would move prices dramatically. Instead, EFP keeps it all under wraps.

EFP is the magic bullet that keeps the wheels of this rigged system greased. It allows the banks to sidestep the market’s natural balancing mechanisms and continue profiting from the artificially maintained spreads.

The Banks’ Vaults and the Illusion of Ownership

Where Is the Metal Really Hiding?

One of the most perplexing—and infuriating—aspects of this system is the opaque nature of physical storage. Both COMEX and LBMA assets, as well as the bullion underlying ETFs like GLD and SLV, are often stored in the same vaults, frequently controlled by the very banks that are manipulating the market. This consolidation means that the “gold” you hear about on the news is, in many cases, nothing more than a number on a ledger.

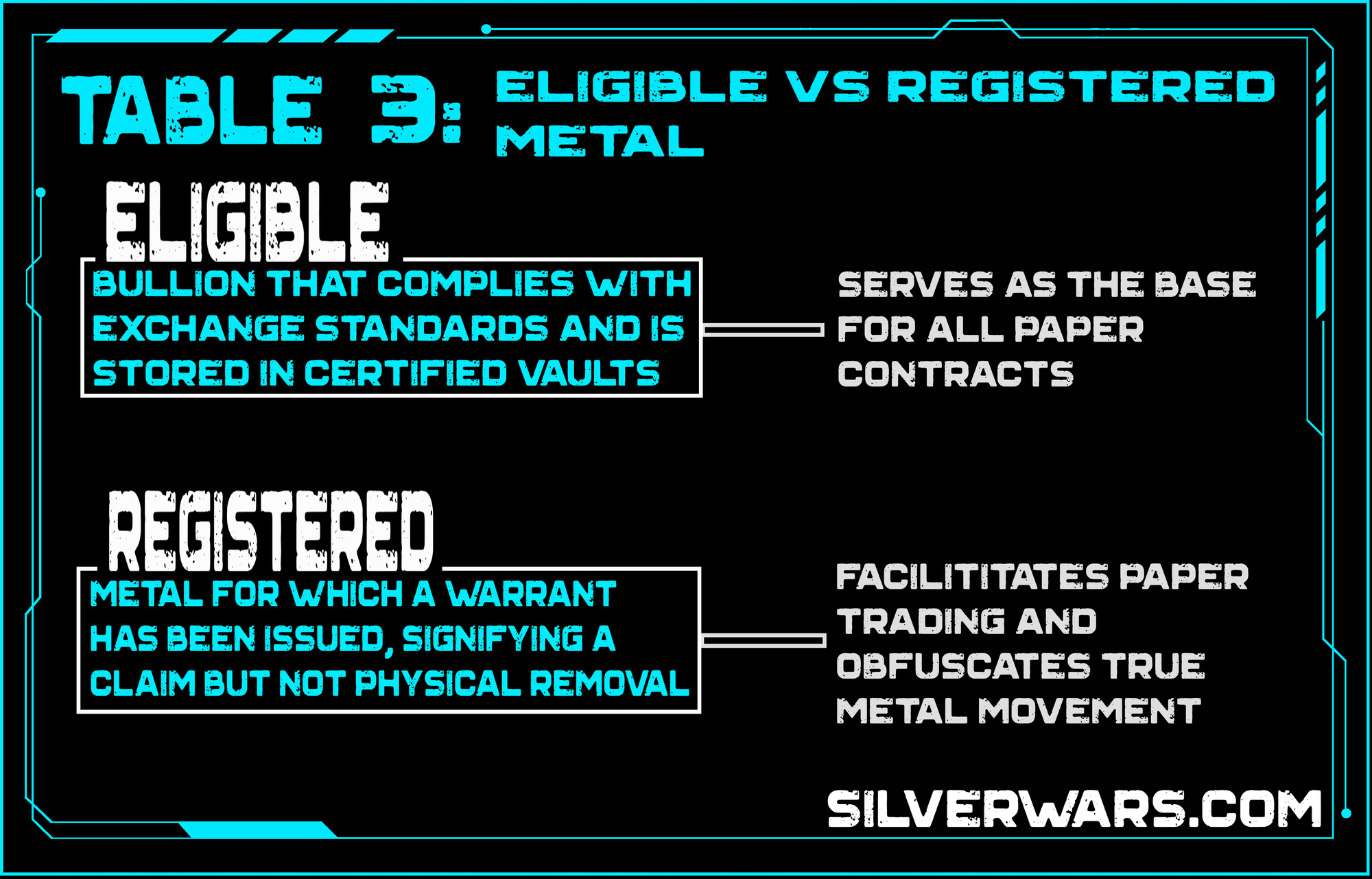

There are two key classifications to understand here:

- Eligible Metal: This is bullion that meets the strict standards set by COMEX and is held in certified vaults. It is the foundation for the paper contracts.

- Registered Metal: When bullion is withdrawn from the eligible pool, a warrant is issued—essentially a piece of paper that represents a claim on that metal. However, the metal itself often remains in the vault, merely tagged with a new label.

This dual classification is central to the deceptive nature of the market. The physical metal may never actually change hands, even though it’s supposedly “traded” on COMEX. Instead, all that happens is a shuffling of paper claims—a process that benefits the financial elites while leaving real investors with nothing tangible.

ETFs: The Façade of Transparency

Gold and silver ETFs, like GLD and SLV, are often touted as accessible ways for everyday investors to own precious metals. But scratch the surface, and you’ll find that these funds are inextricably linked to the same opaque storage systems that underpin COMEX and LBMA trading. The bullion backing these ETFs is often stored in the same vaults used for manipulated trading, and the same banks that manage the EFP transactions are also involved in ETF operations.

This interconnection means that even ETFs, which are supposed to provide an easy, transparent way to invest in gold and silver, are part of the same rigged system. The underlying bullion is nothing more than a paper promise that the banks can repurpose, reassign, or even “borrow” for their own gain.

The US Government and the Gold Revaluation Ruse

In recent months, the US has imported over 2,000 metric tons of physical gold—a move that should be seen for what it is: a strategic maneuver by the government to audit and potentially revalue its gold reserves. The purported total is around 8,133 tons, a number that hardly inspires confidence when you consider the opaque nature of government-held bullion.

What’s the Big Idea?

The government’s rationale is simple: once all the physical gold is audited, it can be revalued to current market prices. This revaluation is not just a numbers game—it’s a power play. By revaluing gold, the government effectively sets a price floor, which in turn underpins the entire financial system that relies on gold as collateral. Think of it like remortgaging your house at a higher value: once you’ve locked in that higher value, it becomes a benchmark for everything else.

- Re-monetization: After revaluation, gold could be used to back US Treasury bonds, providing a stable collateral base.

- Hidden Funds: The money to finance these maneuvers isn’t coming out of thin air. It’s likely being pulled from the vast, unseen reserves hidden within US commercial banks.

- Market Confidence: Once the government revalues gold, market confidence can be bolstered—albeit artificially—to ensure that gold prices do not plummet.

This isn’t a benign exercise in accounting; it’s a deliberate strategy to control the narrative and maintain the power structure that benefits the insiders. The government’s actions, in cahoots with the banks, create an environment where the price of gold remains elevated, regardless of the underlying economic realities.

Silver: The Forgotten Victim in a Rigged Market

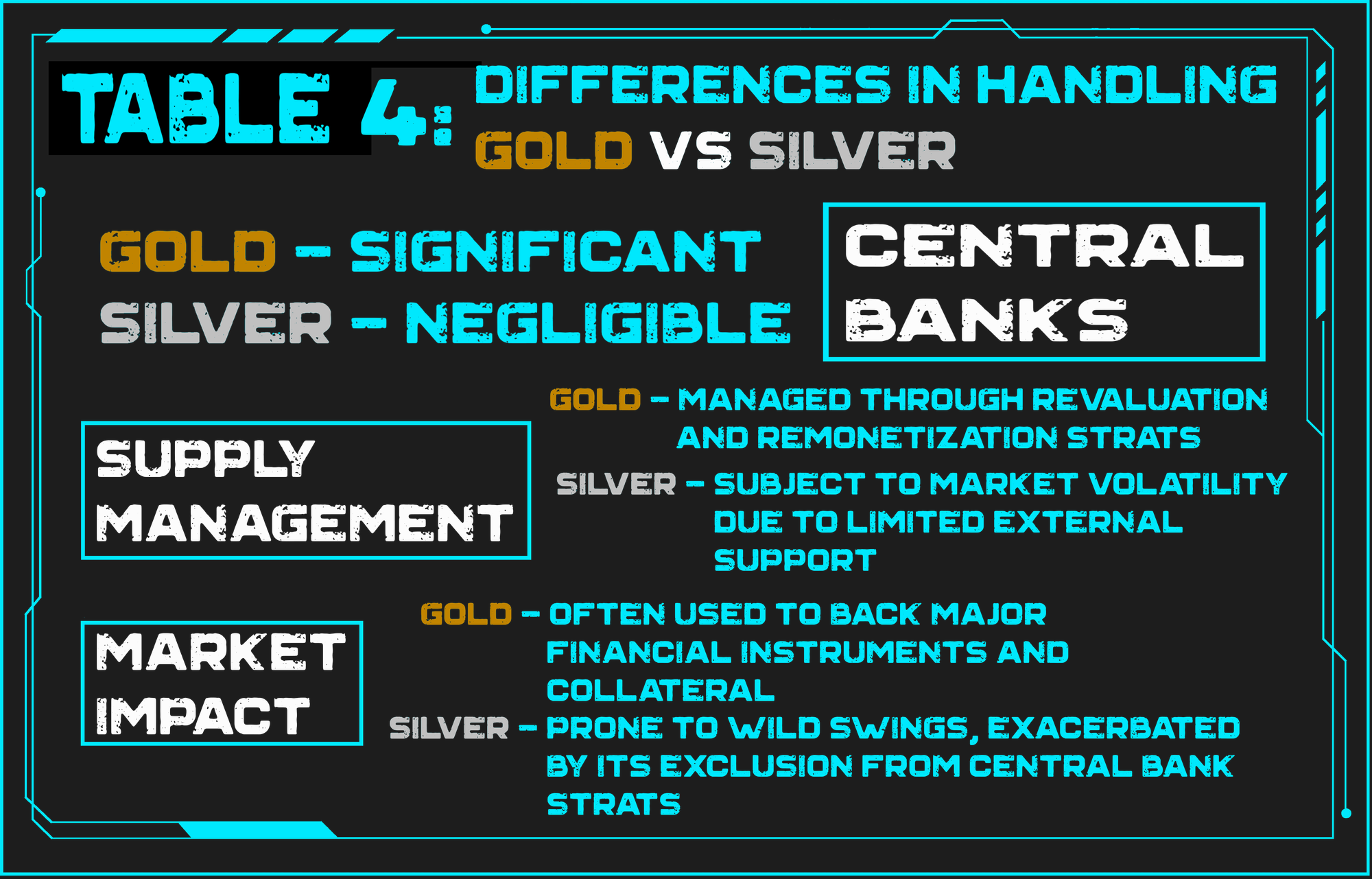

While gold often takes center stage in discussions of monetary policy and government manipulation, silver is its less glamorous but equally exploited cousin. The same mechanisms that manipulate gold prices are used for silver—but with one major difference: there is no central bank backing silver in the same way.

The Silver Conundrum

- No Central Reserve: Unlike gold, where foreign central banks (think Bank of England) can be called upon to provide liquidity, silver is left to fend for itself. There’s no safety net.

- Supply Shortage: Even the so-called “shortage” of silver is a manufactured story, designed to drive up prices artificially while the banks ensure they can profit from the spread.

- Market Volatility: Without a central bank to stabilize the market, silver is prone to more dramatic price swings, making it a less predictable, though no less manipulated, asset.

The neglect of silver by policymakers is a glaring omission, and it leaves silver traders and investors exposed to the whims of a system that favors gold as the ultimate “safe haven” asset.

The Big Picture: A System Engineered for Profit

Let’s sum it up: the entire precious metals market, from COMEX paper contracts to LBMA physical bullion, is a rigged system designed to benefit the insiders—the banks, the government, and their cronies. It’s not about a free market or genuine supply and demand; it’s about maintaining a system that allows those at the top to continuously skim profits.

- Interconnected Markets: The COMEX and LBMA, though operating under different guises, are inextricably linked. The manipulation of one affects the other, creating a seamless system of paper trading and physical storage that benefits the elites.

- Paper vs. Physical: Most transactions are conducted on paper. The physical movement of metal is rare and is executed in ways that obscure the truth. What you’re really buying is a promise—a paper claim that can be manipulated at will.

- EFP and Arbitrage: The Exchange for Physical mechanism is the linchpin of this setup. It allows institutions to settle contracts without triggering market corrections, preserving the artificially maintained spreads.

- Government Involvement: The US government’s recent gold purchases and the potential revaluation of its bullion are not acts of fiscal prudence—they’re strategic moves designed to bolster a rigged system and maintain a price floor that serves the interests of the insiders.

- Silver’s Predicament: While gold enjoys a central bank safety net, silver is left exposed, subject to the same manipulative practices but without the buffering effect of institutional reserves.

A Warning to the Average Investor

If you’re an average investor looking to get a piece of the precious metals market, understand that you’re entering a system where the rules are not made in the public interest. The market is engineered to benefit those who control the levers behind the scenes. The prices you see quoted are less a reflection of economic reality and more a byproduct of calculated manipulation.

It is a rigged system with Gold and Silver that’s rigged to undervalue. In the world of COMEX and LBMA, the property is gold or silver, and the inflated value is maintained through a complex web of paper transactions, opaque storage practices, and government collusion.

Demanding Transparency and Real Value

The truth is, until there is transparency in how precious metals are traded, stored, and valued, the average investor will remain at a disadvantage. The current system is designed not to reflect the true value of gold and silver, but to sustain a profitable cycle for the financial elite.

If you’re serious about sound money, it’s time to question the status quo. Don’t be seduced by the glossy promises of easy gains in a “free market” that is anything but free. Demand transparency, understand the mechanics behind these transactions, and be prepared to act against a system that favors paper over substance.

Investors should push for reforms that would unshackle the market from its current constraints—such as mandated physical delivery, clear disclosure of custodial arrangements, and a move away from manipulative practices like EFP settlements. Only then can we hope to see a market that reflects true supply and demand, rather than one engineered to serve the interests of a select few.

In the meantime, remember this: when you’re faced with a market that appears too good to be true, it probably is. The precious metals market is rife with distortions, and the real value of gold and silver is being kept under lock and key by institutions that thrive on secrecy. As Peter Schiff would say, “If you’re not paying attention, you’re getting fleeced.” It’s high time we opened our eyes to the rigged nature of this system and demanded accountability from those who hold the power.