Is the United States unprepared for a silver supply crisis? Evidence suggests the US is over dependent on foreign imports of critical raw materials and the alarm bells are ringing!

Jose Fernandez, Under Secretary of Economic Growth speaks about the Materials Security Partnership, and their efforts to secure the supply of critical raw materials for the United States.

The challenge the Under Secretary pointed out is the State Department's sources of information are out of date and this is hindering their ability to help out potential critical mineral projects.

"We were getting information about potential projects too late, when it was too late for us to do anything--"

USEG (00:10-00:27): ...the energy transition is at risk, we need more production capacity for critical minerals that need to come online and additionally many of these supply chains– many of the supply chains for critical minerals are concentrated in one or two countries and also lack resilience.

USEG (00:28-00:39): Addressing this challenge requires close coordination between partners and allies, countries with public finance tools, mineral producing countries, and the private sector.

USEG (00:44-00:52): Through the MSP, through the work we are doing at the State Department, we've created several mechanisms to try and deal with this concern.

USEG (00:53-01:00): And to bring in relevant parties from the private sector, from the finance institutions, private equity, producing countries.

USEG (01:14-01:42): Beginning in June 2022, we launched the Minerals Security Partnership, the MSP, which now includes 14 countries, plus European Union, we collectively account for over 50% of the world's GDP and are aim in the MSP is to catalyze public and private sector investments in strategic critical mineral projects to help build more secure, more diverse, and more sustainable critical mineral supply chains.

USEG (02:24-2:40): Tackling this challenge through 4 main lines of effort in the MSP. Sharing information about potential projects, you'd be amazed that at the state department--err- early on we were getting cables, and at the State Department we still have cables folks– okay--

USEG (02:41-2:45): We were getting information about potential projects too late, when it was too late for us to do anything--

USEG (03:10-03:22): Expanding offtake and recycling opportunities in critical materials projects because the experts will tell you that in 5-10 years as much as 20-25% of our EV batteries will come from recycled components.

(Story Continues Below)

It may be that the US is just out of time to mitigate the silver supply deficit, as according to SAFE, stockpiles won't resolve the issue of global dependence on China for critical materials.

"A stockpile is not a bad thing, but won't resolve the issue of global dependence on China for critical minerals" - SAFE

A stockpile is not a bad thing, but won't resolve the issue of global dependence on China for critical minerals.

— SAFE (@Securing_Energy) September 26, 2024

Similar to oil: Strategic Petroleum Reserve helps in emergencies, but we're energy secure through domestic oil/gas production, and (increasingly) options like EVs. https://t.co/NMQEhdJxn9

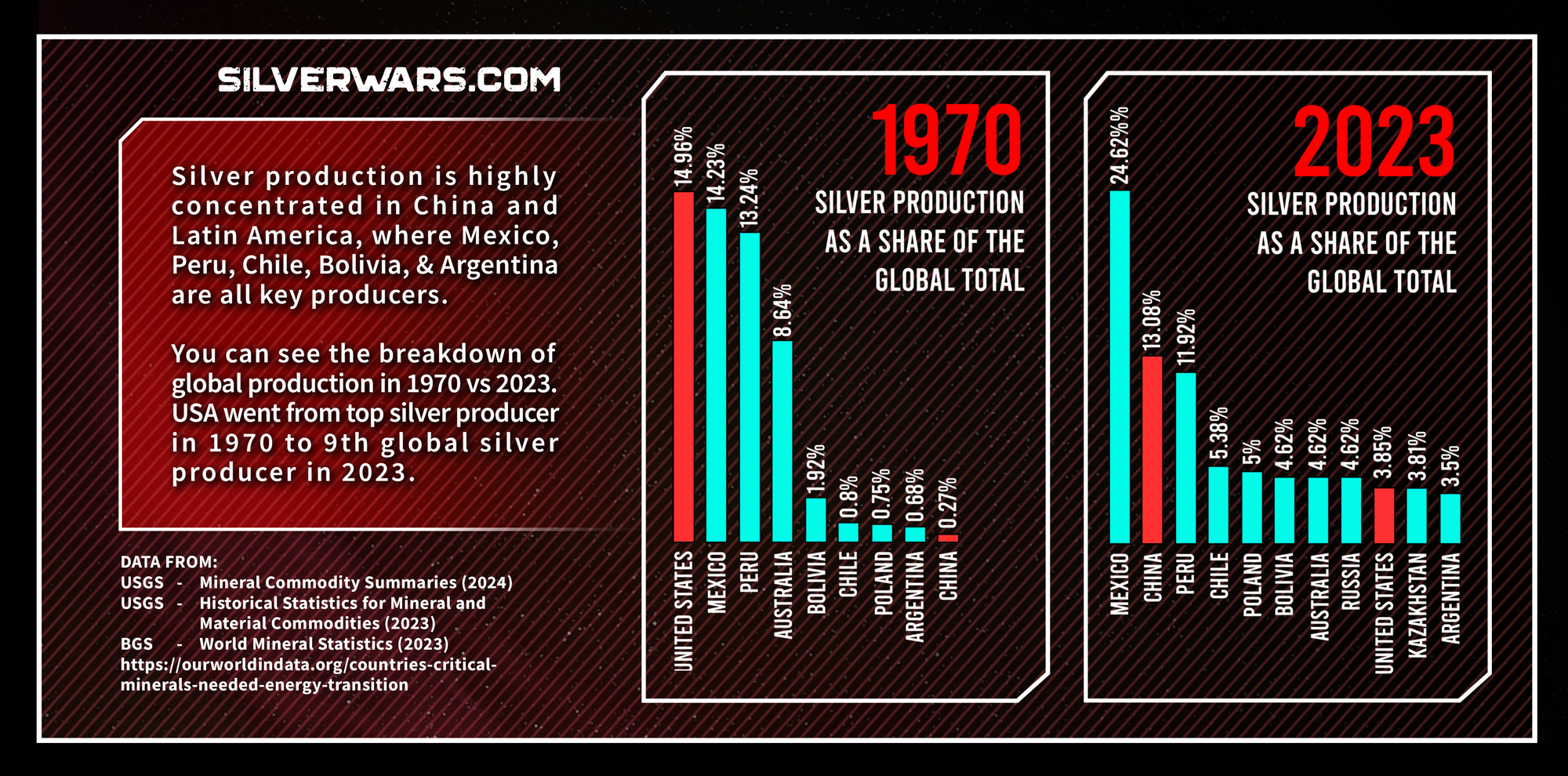

SilverWars continues to be concerned with the lack of focus of the United States with assigning silver its critical status. When looking at the picture from 1970 to 2023, the United States has gone from the biggest producer of silver to the 9th in global statistics.

During the Reagan administration, part of US silver stockpile was sold to heal the market after the Hunt Brothers drove the price of silver up. At the time, FEMA officials cited a GAO study concluding that if a three-year conventional war cut off all other supplies the nation's silver needs could be filled by the United States, Canada and Mexico.

Much has changed since, with the United States producing less and less silver every year, while in the same timeframe both China and Mexico have grown over 10% in global total.

Is the US too reliant on its foreign sources of silver?

Jennifer Hillman, a professor at Georgetown University Law Center, said during a SAFE panel discussion in late October that Trump’s plan for steep and broadly imposed tariffs would make it harder for the U.S. EV sector to ramp up compared to the rest of the world. That’s because the U.S. has a very limited industry around mining critical minerals and no industry at all for processing them, which makes the nation heavily reliant on other countries like China for raw or processed materials, their byproducts and relevant technical expertise, said Hillman.

“I think it would be very, very difficult to see how the United States continues to grow its own industry in the wake of [steep tariffs on critical minerals],” Hillman said during a webinar hosted by the energy security think tank SAFE. “In other words, I think it would be a major setback in terms of timing.”

The geopolitical situation transpiring may have dire affects on the future ability of the US to source its ambitious silver needs, severely hindering its national security.

Department of Homeland Security

> Threat of Limited U.S. Access to Critical Raw Materials - Executive Summary

"This 2024 Public-Private Analytic Exchange Program team explored the implications of U.S. industry's inability to obtain or maintain access to supplies of critical raw materials (CRM). Despite some policy efforts by U.S. government and private industry alliances and working group, CRM shortages are projected to escalate and become a critical challenge to the U.S. economy due to increasing demand, coupled with the outsized control that foreign adversaries exert over CRM supplies chains."

German Federal Ministry for Economic Cooperation and Development

> Sustainable Global Supply Chains Annual Report 2023

"The high-tech and electronics sector (H&E sector) is a fundamental pillar of the global economy, underpinning technological advances and facilitating innovation across industries. Its contributions extend beyond specific products, shaping the infrastructure and capabilities of sector ranging from healthcare and finance to national defense and the military. Because H&E products and components are so critical to a country's future economic, technological, and military trajectory, the sector is increasingly at the crossroads of geopolitical power plays.

The H&E sector is made up of a wide range of components and products that rely on a variety of raw materials, such as plastics, ceramics, and glass and, most importantly, metals such as copper, lithium, tin, silver, gold, nickel, and aluminum. China is the leader in the extraction of many minerals and, more importantly, accounts for most of the world's mineral processing, particularly rare earth elements. This concentration of mineral processing in China has been a key element that has also allowed the country to take a leading position in the production of many (though not all) upstream H&E components, such as electronic integrated circuits, electric motors and generators, and batteries."

Financial Times

> Western Nations Join Forces To Break China's Grip on Critical Materials

Western nations are directing their development finance and export credit agencies to work with private industry to support critical minerals projects, in a drive to break China's chokehold over a sector that is essential for high-tech industries.

Jose Fernandez, US under-secretary of state for economic growth, said a further 30 critical minerals mining projects are being evaluated by the MSP (Minerals Security Partnership), as western governments race to secure the raw materials needed to make everything from electric vehicles to advanced weapons.

"What China is doing is following the playbook of the monopolist to drive out competition," said Fernandez, who accused Beijing of engaging in "overproduction and predatory pricing" to retain its grip on global supply of critical mineral.

(Sources Cited Below)

(Sources)

https//www.secureenergy.org/ee-news-trumps-tariff-game-could-chill-the-nations-ev-push

https://www.x.com/Securing_Energy/status/1839326473876074734

https://www.ft.com/content/2984ae03-df15-420b-89cc-9ad8337014a9

https://www.washingtonpost.com/archive/politics/1981/03/20/administration-plans-sale-of-more-than-third-of-stockpiled-silver/b6dbdcec-1fe6-427c-babd-4c58113611fe/